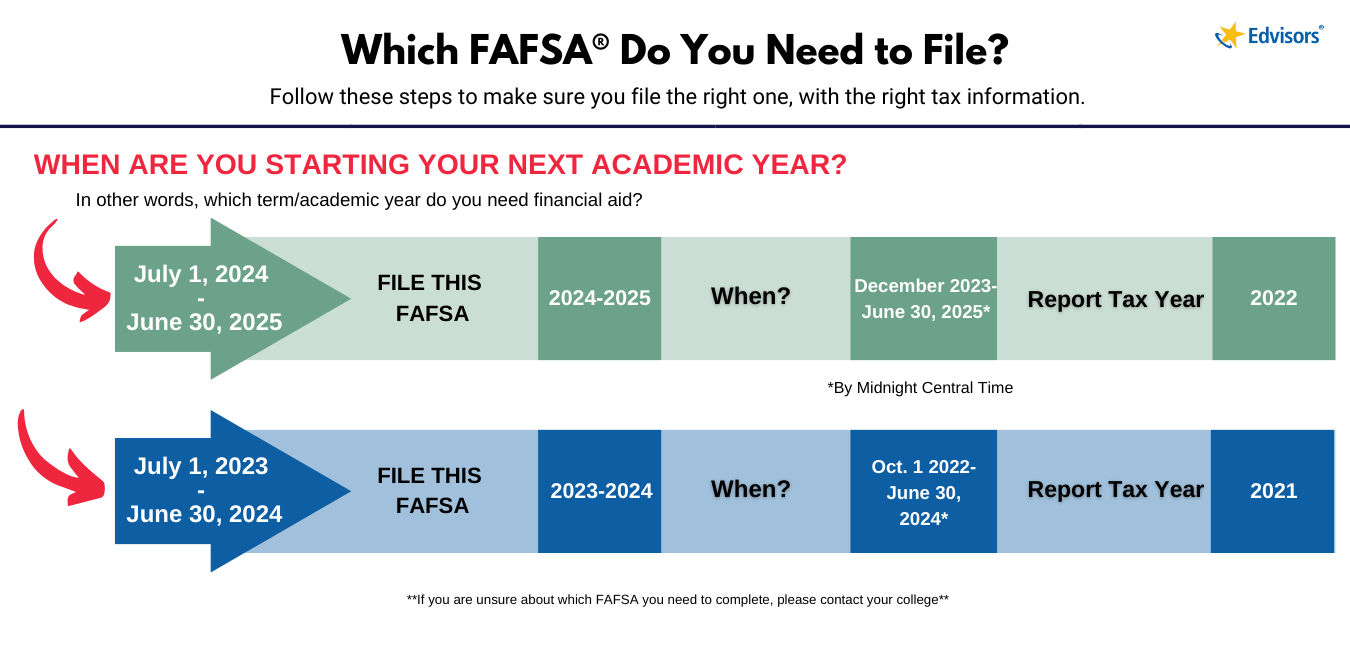

FAFSA deadlines can vary. The FAFSA for the 2024-2025 academic year would typically open on October 1 and remains open until June 30, 2025. However, the 2024-2025 FAFSA release has been delayed. The U.S. Department of Education has indicated that the 2024-2025 FAFSA will be available by Dec. 31, 2023. You do have to wait until the FAFSA is released to apply, and it is recommended that you apply as soon as you can in order to qualify for as much financial aid as possible.

To determine which FAFSA to file, and when you should file in order to maximize your federal and state aid funds, keep reading.

The Free Application for Federal Student Aid (FAFSA®) is used to apply for federal grants and student loans. Many states and schools rely on the information provided in the FAFSA to determine a student’s eligibility for state and institutional school aid, as well.

- The FASFA deadline for the 2023 - 2024 academic year is June 30, 2024

- The FAFSA deadline for the 2024-2025 academic year is June 30, 2025

- There are three FAFSA deadlines you should track: school deadline, state deadline, and federal deadline.

- The most important deadline is the deadline that comes first

- The earlier you file the FAFSA, the more aid you may qualify for

FAFSA Deadlines

There are three FAFSA deadlines you need to keep in mind. The most important FAFSA deadline will be the one with the earliest date.

When Is the FAFSA Due?

The most important FAFSA deadline is the FAFSA deadline which comes first. To be on the safe side, you do want to file the FAFSA as soon as possible. As long as the FAFSA you need to file is open, there is no such thing as filing your FAFSA too early.

Which FAFSA Should You File?

Federal student aid has an award year that runs from July 1 to June 30. The FAFSA has a 21-month application cycle that begins on October 1, nine months before the start of the award year, and ends on June 30, the last day of the award year. The exception is the 2024-2025 FAFSA whose application cycle will begin in December. Because of the way the application cycle works, there is an overlap of a few months, so you may see a choice between two FAFSA applications when you log in.

Here's how to determine which FAFSA to file:

FAFSA Deadline by State

State FAFSA deadlines may be earlier than the federal deadline. To increase your chances of receiving state aid, in addition to federal aid, it is important to know the deadline for your state of residence. In addition to varying deadlines, some states award aid on a first-come, first-served basis. See the table below.

States may also have their own additional financial aid application forms to complete.

To be on the safe side, file as early as possible!

Please note:

- The state FAFSA deadlines may have already passed. If so, prepare for next year’s form by adding a reminder to your calendar. Most state deadlines remain similar year after year.

- State forms do not replace filling out the FAFSA. You must fill out the FAFSA to receive federal student aid.

- The state deadline to note is that of your state of legal residence.

- Additional forms may be required. Contact your high school’s counselor, your college’s financial aid administrator or your state agency for more information.

- Applicants should keep a copy of their submission of the FAFSA as well as any additional state forms.

- Applicants should obtain a Certificate of Mailing and/or Delivery Confirmation for forms sent by postal mail.

- Date received means received by the U.S. Department of Education, unless otherwise indicated.

FAFSA Deadline by School

The next deadline to look up is your school’s deadline. The best place to look is on the school’s financial aid page. If you are having trouble finding it, you should give the school a call.

If you’re applying to multiple schools, you will need to look up the deadline for each school. And the most important deadline is the earliest one!

Federal FAFSA Deadline

And finally, the deadline to keep in mind, the federal deadline which is June 30 of the end of the award year. For example, for the 2023 - 2024 FAFSA the 2023 - 2024 award year is July 1, 2023 through June 30, 2024. So the federal deadline for the 2023 - 2024 FAFSA is June 30, 2024.

The federal deadline for the 2024-2025 FAFSA is June 30, 2025.

If you are confused about which FAFSA you should complete, you should contact your financial aid office.

State Financial Aid Deadlines

The table below is intended to educate students on state deadlines. It is always best to confirm state-related information with your high school counselor, financial aid advisor, or applicable state agency.

| State / Territory | 2023-2024 Deadlines | 2024-2025 Deadlines | |

|---|---|---|---|

| Alabama | AL | Check with your financial aid administrator | Check with your financial aid administrator |

| Alaska1 | AK | AK Education Grant - As early as possible after Oct. 1, 2022 AK Performance Scholarship - June 30, 2023 |

AK Education Grant - As early as possible after Dec. 31, 2023 All other aid: Check with your financial aid office at your school; additional forms may be required |

| American Samoa2 | AS | Check with your financial aid administrator | Check with your financial aid administrator; additional forms may be required |

| Arizona | AZ | Check with your financial aid administrator | Check with your financial aid administrator |

| Arkansas | AR | Academic Challenge: July 1, 2023, by midnight CT ArFuture Grant (fall term): July 1, 2023, by midnight CT ArFuture Grant (spring term): Jan. 10, 2024, by midnight CT |

Academic Challenge: July 1, 2024, by midnight CT Arkansas Future Grant (fall term): July 1, 2024, by midnight CT Arkansas Future Grant (spring term): Jan. 10, 2024, by midnight CT |

| California | CA |

For many state financial aid programs: March 2, 2023 (date postmarked) Cal Grant also requires submission of a school-certified GPA by March 2, 2023 For additional community college Cal Grants - September 2, 2023 - (date postmarked) (If you’re a noncitizen without a Social Security card or had one issued through the federal Deferred Action for Childhood Arrivals program, you should fill out the California Dream Act Application found at dream.csac.ca.gov. |

For many state financial aid programs: April 2, 2024 (date postmarked) Cal Grant also requires submission of a school-certified GPA by April 2, 2024 For additional community college Cal Grants - September 2, 2024 - (date postmarked) All Other Aid |

| Colorado | CO | Check with your financial aid administrator | Check with your financial aid administrator |

| Connecticut2 | CT | Feb. 15, 2023, by midnight CT for priority consideration; additional forms might be required | Feb. 15, 2024, by midnight CT for priority consideration; additional forms might be required All other aid: check with your financial aid office |

| Delaware | DE | May 15, 2023, by midnight CT |

May 15, 2024, by midnight CT All other aid: check with your financial aid office |

| District of Columbia2 | DC |

July 1, 2023 (date received), for priority consideration Aug. 1, 2023 for DCTAG, complete the DC OneApp and submit additional supporting documents for priority consideration. |

June 25, 2024 (date received), for priority consideration For DC Tuition Assistance Grant: complete the DC OneApp and submit additional supporting documents by July 1, 2024, for priority consideration. All other aid: check with your financial aid office |

| Federated States of Micronesia2 | FM | Check with your financial aid administrator | Check with your financial aid administrator |

| Florida | FL | May 15, 2023 (date processed) |

May 15, 2024 (date processed) All other aid: check with your financial aid office |

| Georgia2 | GA | As soon as possible after Oct. 1, 2022. Additional forms may be required. |

ASAP after Dec. 31, 2023 All other aid: check with your financial aid office |

| Guam | GU | Check with your financial aid administrator | Check with your financial aid administrator |

| Hawaii | HI | Check with your financial aid administrator | Check with your financial aid administrator |

| Idaho2 | ID | Opportunity Grant - March 1, 2023, by midnight CT for priority consideration. |

Opportunity Scholarship- March 1, 2024, by midnight CT All other aid: check with your financial aid office |

| Illinois1 | IL | As soon as possible after Oct. 1, 2022. Visit Illinois Student Assistance Commission for Monetary Award Program (MAP) deadline dates. | Monetary Award Program (MAP) Apply as soon as possible after the filing period begins. Visit isac.org for MAP deadline dates. All other aid: check with your financial aid office |

| Indiana2 | IN |

Adult Student Grant: As soon as possible after Oct. 1, 2022. New applicants must submit additional forms at ScholarTrack.IN.gov Workforce Ready Grant: As soon as possible after Oct. 1, 2022 Frank O'Bannon Grant: April 15, 2023 21st Century Scholarship: April 18, 2023 |

Adult Student Grant: As soon as possible after Dec. 31, 2023. New applicants must submit additional forms at ScholarTrack.IN.gov Workforce Ready Grant: As soon as possible after Dec. 31, 2023 Frank O'Bannon Grant: April 15, 2024 21st Century Scholarship: April 15, 2024 |

| Iowa | IA | July 1, 2023 by midnight CT; earlier priority deadlines may exist for certain programs |

July 1, 2024 by midnight CT; earlier priority deadlines may exist for certain programs All other aid: check with your financial aid office |

| Kansas2 | KS | April 1, 2023 by midnight CT; contact financial aid administrator or state agency, additional forms may be required | April 1, 2024 (date received) All other aid: check with your financial aid office |

| Kentucky1 | KY | As soon as possible after Oct. 1, 2022 | As soon as possible after Dec. 31, 2023 All other aid: check with your financial aid office |

| Louisiana | LA | July 1, 2024 (Feb. 1, 2023 recommended) | July 1, 2025 (Feb. 1, 2024 recommended) All other aid: check with your financial aid office |

| Maine | ME | May 1, 2023, by midnight CT | May 1, 2024, by midnight CT All other aid: check with your financial aid office |

| Marshall Islands2 | MH | Check with your financial aid administrator | Check with your financial aid administrator |

| Maryland | MD | March 1, 2023, by midnight CT | March 1, 2024, by midnight CT All other aid: check with your financial aid office |

| Massachusetts | MA | For priority consideration, May 1, 2023, by midnight CT | For priority consideration, May 1, 2024, by midnight CT All other aid: check with your financial aid office |

| Michigan | MI | May 1, 2023, by midnight CT | May 1, 2024, by midnight CT All other aid: check with your financial aid office |

| Minnesota | MN | 30 days after term starts, by midnight CT | June 30, 2025, by midnight CT All other aid: check with your financial aid office |

| Mississippi | MS |

MTAG and MESG Grants: Oct. 15, 2023 by midnight CT HELP Scholarship: April 30, 2023 by midnight CT |

MTAG and MESG Grants: Oct. 15, 2024 by midnight CT HELP Scholarship: April 30, 2024, by midnight CT All other aid: check with your financial aid office |

| Missouri | MO | For priority: Feb. 1, 2023. Applications accepted through April 1, 2023, by midnight Central time. | For priority: Feb. 1, 2024. Applications accepted through April 1, 2024, by midnight CT |

| Montana2 | MT | For priority consideration, Dec. 1, 2022 - check with financial aid officer | For priority consideration, Dec. 31, 2024; additional forms may be required All other aid: check with your financial aid office |

| Nebraska | NE | Check with your financial aid administrator | Check with your financial aid administrator |

| Nevada1,2 | NV | Silver State Opportunity Grant: As soon as possible after Oct. 1, 2022 Nevada Promise Scholarship: March 1, 2023 All other aid: Check with your financial aid administrator |

Silver State Opportunity Grant: As soon as possible after Dec. 31, 2023 Nevada Promise Scholarship: March 1, 2024 All other aid: Check with your financial aid administrator |

| New Hampshire | NH | Check with your financial aid administrator |

Check with your financial aid administrator |

| New Jersey | NJ |

Renewal applicants(2022-2023 Tuition Aid Grant recipients): April 15, 2023 by midnight CT All other applications: |

Renewal applicants (2023-24 Tuition Aid Grant recipients): April 15, 2024, by midnight CT |

| New Mexico | NM | Check with your financial aid administrator | Check with your financial aid administrator |

| New York2 | NY | June 30, 2024, by midnight CT | June 30, 2025, by midnight CT All other aid: check with your financial aid office |

| North Carolina1 | NC | As soon as possible after Oct. 1, 2022 |

UNC System Institutions: All other aid: check with your financial aid office |

| North Dakota1 | ND | As soon as possible after Oct. 1, 2022 |

As soon as possible after Dec. 31, 2023 All other aid: check with your financial aid office |

| Northern Mariana Islands1 | MP | For priority consideration, April 30, 2023, by midnight CT | April 30, 2024, by midnight CT All other aid: check with your financial aid office |

| Ohio | OH | Oct. 1, 2023, by midnight CT | Oct. 1, 2024, by midnight CT All other aid: check with your financial aid office |

| Oklahoma1 | OK | As soon as possible after Oct. 1, 2022 |

Contact your financial aid office |

| Oregon1,2 | OR | Oregon Opportunity Grant: As soon as possible after Oct. 1, 2022 OSAC Private Scholarships: March 1, 2023 Oregon Promise: Contact your state agency |

Oregon Opportunity Grant: As soon as possible after Dec. 31, 2023 Oregon Promise and other state grants: Contact your state agency for more information OSAC Private Scholarships: March 1, 2024 All other aid: check with your financial aid office |

| Palau2 | PW | Check with your financial aid administrator | Check with your financial aid administrator |

| Pennsylvania2 | PA |

All first-time applicants at a community college; a business/trade/technical school; designated Pennsylvania Open-Admission institution; hospital school of nursing; or enrolled in a non-transferable two-year program: Aug. 1, 2023, by midnight CT All other applicants: May 1, 2023, by midnight CT |

All first-time applicants at a community college; a business/trade/technical school; designated Pennsylvania Open-Admission institution, or a hospital school of nursing; or enrolled in a non-transferable two-year program: Aug. 1, 2024, by midnight CT |

| Puerto Rico | PR | Check with your financial aid administrator | Check with your financial aid administrator |

| Rhode Island2 | RI | Check with your financial aid administrator |

Check with your financial aid administrator |

| South Carolina1 | SC | Tuition Grants: June 30, 2023, by midnight CT SC Commission on Higher Education Need-based grants: As soon as possible after Oct. 1, 2022 |

Tuition Grants: June 30, 2024, by midnight CT SC Commission on Higher Education Need-based grants: As soon as possible after Dec. 31, 2023 All other aid: check with your financial aid office |

| South Dakota2 | SD | Check with your financial aid administrator | Check with your financial aid administrator |

| Tennessee1 | TN |

State Grant: March 1, 2023, prior-year recipients receive award if eligible and apply by deadline. All other awards made to neediest applicants until funds are depleted. TN Promise: March 1, 2023, by midnight CT State Lottery - Fall term: Sept. 1, 2023, by midnight CT State Lottery - Spring & summer terms: Feb. 1, 2024, by midnight CT

|

State Grant, prior-year recipients must apply by April 15, 2024. All other awards are made to the neediest applicants. For TN Promise: April 15, 2024, by midnight CT For State Lottery - Fall term: Sept. 1, 2024, by midnight CT Spring & summer terms: Feb. 1, 2025, by midnight CT All other aid: check with your financial aid office |

| Texas2 | TX | For priority consideration: Jan. 15, 2023 Private and two-year institutions may have different deadlines |

For priority consideration: March 15, 2024 Private and two-year institutions may have different deadlines All other aid: check with your financial aid office |

| U.S. Virgin Islands2 | VI | Check with your financial aid administrator | Check with your financial aid administrator |

| Utah1 |

UT | Check with your financial aid administrator |

Opportunity Scholarship: go to opportunityscholarhip.org for application and deadline information. |

| Vermont1,2 | VT | As soon as possible after Oct. 1, 2022 | As soon as possible after Dec. 31, 2023 All other aid: check with your financial aid office |

| Virginia2 | VA | As soon as possible after Oct. 1, 2022. Deadlines will vary by institution. Contact your financial aid office for more information. | As soon as possible after Dec. 31, 2023 Virginia Alternative State Aid Application: For students ineligible for federal student aid but meet financial aid program and residency requirements of Virginia, go to VASAapp.org. All other aid: check with your financial aid office |

| Washington1 | WA |

As soon as possible after Oct. 1, 2022. Students ineligible for federal aid but who meet state financial aid program and residency requirements should complete the Washington Application for State Financial Aid at https://wsac.wa.gov/wasfa instead of the FAFSA form. Contact the Washington Student Achievement Council (https://wsac.wa.gov/wasfa) or your financial aid administrator for more information. |

As soon as possible after Dec. 31. 2023 Students ineligible for federal aid but who meet state financial aid program and residency requirements should complete the Washington Application for State Financial Aid. Contact the Washington Student Achievement Council or your financial aid administrator for more information. All other aid: check with your financial aid office |

| West Virginia2 | WV |

For PROMISE Scholarship: March 1, 2023 For WV Higher Education Grant Program: April 15, 2023 For WV Invest Grant: For priority consideration by April 15, 2023 |

PROMISE Scholarship - March 1, 2024 Contact your financial aid administrator or your state agency. For WV Higher Education Grant Program - April 15, 2024 For WV Invests Grant: April 15, 2024, for priority consideration All other aid: check with your financial aid office |

| Wisconsin | WI | Check with your financial aid administrator | Check with your financial aid administrator |

| Wyoming | WY | Check with your financial aid administrator | Check with your financial aid administrator |

1Awards made until funds are depleted

2Additional forms may be required. When possible, Edvisors has linked to the applicable site.

Learn More About Federal Student Aid

Student Parent Financial Information