The content and opinions provided on this site have not been provided or commissioned by any issuer of the financial products and/or services appearing on this site. The content and opinions have not been reviewed, approved or otherwise endorsed by an issuer. Offers may be subject to change without notice. For more information, please read our full disclaimer.

The stock market can feel a bit intimidating when you’re just starting out. But once you get the hang of the basics—like what stocks are, how to trade them, and why they’re a smart investment option—it all starts to make sense. Keep reading to boost your understanding and tackle the stock market with confidence!

- The stock market is a platform for buying and selling publicly traded company stocks.

- Companies issue stocks as a means of raising capital, allowing investors to become part owners of the business.

- Investing in the stock market has two main benefits when company circumstances are positive - income through dividends and capital gains achieved through price appreciation of a stock.

- Successful stock market investing requires research and analysis of factors such as company performance, economic outlook, and industry trends.

What is a Stock?

Public companies sell ownership in their company and the way they do it is called a share. A share represents a fraction of ownership. When you own a share of a company, you are considered a shareholder and can take part in the company’s profits. When you decide to invest in a company, you want to choose companies you believe will increase in value. As the value of the company increases, the price of the share you own increases as well. This share can then be sold for a profit (the difference between the sell price of the share minus the cost you originally paid). This enables you to either reinvest that profit elsewhere or use the money for some other purpose.

Stocks offer benefits to both companies and shareholders. They can supply companies with necessary funds for various purposes like debt settlement, product development, and growth. However, it's crucial to recognize that stocks carry risks. When a company underperforms and its stock value drops, investors may face financial losses. Investing in the stock market does not assure profits; this uncertainty elevates the inherent risk associated with stock market investments.

What is the Stock Market?

Stock markets are exchanges that facilitate the trading of company stock among various investors. In New York City, Wall Street is renowned for housing the New York Stock Exchange (NYSE). On the other hand, the Nasdaq, a notable exchange, operates without a physical trading floor and relies on data centers for transactions.

When private companies decide to "go public," they offer investors the opportunity to participate in ownership by selling shares of their company stock through an exchange. This process is known as an initial public offering (IPO). Following the IPO, investors can sell their shares on the market to other investors. The prices are determined based on the collective buying or selling activity of investors for a particular stock. Depending on the exchange, it may function like an auction where buyers and sellers directly trade (NYSE), or it may require working with a broker who executes trades on your behalf (Nasdaq).

Using tools such as a market index are a good way to measure the overall performance of the stock market. The indexes (such as the Dow Jones or S&P 500) are composed a collection of companies that give investors a good idea of how the stock market as a whole is doing. In the case of the S&P 500, it is an index of the 500 largest companies in the United States and can give an accurate picture of how U.S. industry leaders are performing.

Making Money with Stocks

While there’s no sure way to predict what will happen with a specific stock, the historic average annual return for the stock market is 10%. While the market doesn’t always increase every year, you are more likely to see a positive return on your stocks if you plan to hold onto your stocks for a couple years (or longer).

Buy low and sell high. The ups and downs of the market can cause investors to react by quickly buying and selling stocks to try to keep up with fluctuation and prevent losses. They are looking to make money as they try to sell at a higher cost than they originally purchased the stocks for, or if the price of the stock is declining and they may want to minimize any losses.

Example of buying low and selling high: if you buy 50 stock shares of Company X for $10 each (so you’ve initially invested $500 in the market and now own 50 shares of Company X). If you sell those shares for $30 each, you will be earning $1500 total on the sale and making a $1,000 profit on your investment. Mind you, this is before any taxes or other costs/fees you may owe. Needless to say, everyone desires this scenario, but a 200% profit certainly is not typical.

Invest in dividend stocks. Dividend stocks tend to come from well-established companies. These companies pay investors a portion of their earnings each quarter, called a dividend. Some payouts increase over time. Historically, the S&P 500 yields a 2-5% dividend, so carefully do your research to understand dividends you can expect to receive. Standards and Poors companies (S&P) are called blue chip because they are typically nationally recognized and financially sound, and as such they are seen as good low-risk investments. For example, Apple stock has a .59% annual dividend yield which results in a $0.23 quarterly dividend amount per share.

Stock prices increase and decrease due to many different economic factors such as:

- Interest rates and inflation

- Economic conditions around the world

- Politics

- Companies’ financial health and overall performance

- Supply and demand

Trading Information

When it comes to discussing and researching the market, you may find yourself coming across stock quotes and new terminology. Let’s help you make sense of it.

Stock Quotes

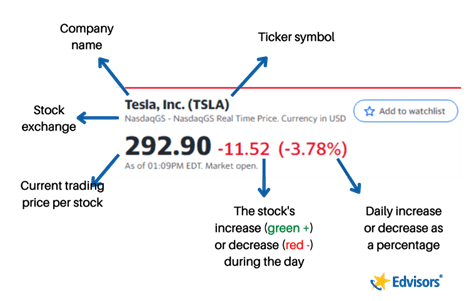

While not all stock quotes will have this information in the exact same place, the following information will all be present:

Difference Between Stock Market Crash vs. Correction

A stock market crash is when the market as a whole loses a significant amount of value in a short period of time. A market correction is defined as market losses totaling more 10% but less than 20% over a period of time. The famous Wall Street market crash of 1929 sent the Dow Jones Industrial Average down 11% in one day and this event triggered the beginning of the Great Depression (a depression is an extreme economic downturn). Depressions are extremely rare while recessions are more common. A recession is a decline in economic activity that lasts more than a few months. We have endured a number of economic recessions over time and when these occur you can expect market selloffs as people try to minimize losses in the market.

Smaller corrections (or decreases up to 10%) can be misunderstood, especially for those just starting out in the markets. It’s important to understand that stock market corrections will only impact the economy and the market for short periods of time rather than the long-lasting effects that recessions can cause. Many of the stock market corrections we’ve seen over the last 50 years have lasted three months or less.

Bear Markets vs Bull Markets

The daily ups and downs of the market are rarely predictable and the volatile nature of the market is to be expected. However, when a trend can be seen in the market over time, that activity can be labeled.

A bull market is when the stock market is rising (or expected to rise) more than 20% from the previous year’s peak. A bear market is when the market falls by 20%. These seemingly large rises and falls will not happen overnight but rather over a period of several months and can represent a shift in the economy, the political sphere, or job market, among other things.

Risks and Benefits of Stocks

There are some stocks that seem to make investors rich overnight, and they very well might (but know that these are rare). Stocks that are seen as high-risk can have large payouts and may appear attractive for that reason, but you are just as likely to lose your money in a high-risk company as you are to gain. There is also a reactive mentality to sell during a market decline, fearing you are going to lose money, but if you are willing to ride it out, your patience may be rewarded.

While it’s certainly possible to realize large gains in the stock market, for most it usually happens over a long period of time. If you are just beginning in the stock market, it is best to find some stocks that have historically performed well and keep your focus on the long game: that is, buy-and-hold investing.

How to Invest in the Stock Market

When investing in the stock market, there are several options available to you. You can choose to buy individual stocks through either a personal broker or an online stockbroker. If you opt for individual stocks, you simply provide your broker with the stock name and quantity either in-person or through an electronic request. It's important to exercise caution when dealing with similar ticker symbols to ensure you purchase the correct shares. After your broker sends your order to the exchange, a market maker will sell you the desired shares at the current market price, which will then be added to your account.

If you have a 401(k) you may also have mutual funds that range from conservative to aggressive in nature. Your mutual fund may offer a combination of stocks and bonds, as well as other kinds of market investments and financial assets intended to grow wealth. In this case, you may already be invested in the stock market and not even be aware of it!

Tips for Investing in the Market

1. Create a diverse portfolio

Owning a variety of stocks from different sectors in the stock market can help reduce your risk and possibility of permanent loss. The volatility of the market means that while you may make a good amount of money on a single winning stock, you may also lose a lot if you only choose one company to buy stock in. Having a collection of at least 10 companies from a diverse group of companies that you believe will have strong investments over the long term is a good strategy. If you are looking for a more hands-off approach, purchasing shares in a mutual fund, index fund, or exchange-traded fund (ETF) will give you a broad exposure to a collection of diverse stocks.

2. Plan to invest for the long term

Long-term investing gives your money time to grow and ideally, yield a positive result. Historically successful companies have a greater probability to continue to generate positive returns. Because you want to leave time for your money to grow, invest money you do not plan on needing in the next five or more years.

It’s also important to note that the sales of stocks are taxable, (with the exception of tax-deferred retirement accounts, such as an IRA). Stocks that have been held for longer than a year which is considered “long-term,” may have a capital gains taxes dependent on your tax bracket and income. Short-term capital gains taxes are also dependent on your income tax bracket. and can range between 10% and 37%.

3. Start investing now

It’s not too late to begin investing! While stocks may have a decline from time to time, overall, there is a general upward trend. Despite the volatility, the benefits add up over years.

Compound interest also can work in your favor, growing your initial investment and reinvesting the profits. (For example, over the course of about 30 years, a $550/a month investment in an S&P 500 index fund has been turned it into $1 million.)

The oft-shared strategy of investing in a bear market (low) with the intent of selling high (bull market) can be worthwhile, but if you are looking to invest in low-cost stock, it is important to research the fundamentals and history of a stock. Purchasing in a bear market is good, as long as the stock gradually increases, as opposed as some stock that may end up being delisted (and results in a permeant loss).

Set Personal Financial Goals

Having a financial game plan can help you determine the length of time you need to plan for your investments. Goals such as retirement, a college fund, creating funds for the down payment of a house, or other long-term goal may be a good place to start your financial journey.