The content and opinions provided on this site have not been provided or commissioned by any issuer of the financial products and/or services appearing on this site. The content and opinions have not been reviewed, approved or otherwise endorsed by an issuer. Offers may be subject to change without notice. For more information, please read our full disclaimer.

Credit is an arrangement where you borrow money, usually from a bank, and agree to repay it later, often with interest. When you apply for additional credit, lenders examine your track record of borrowing and repayment. This helps them determine if you’re reliable when it comes to making timely payments.

How does Credit Work?

Access what you need now, even if you can't afford it upfront, with the assistance of credit. When you utilize credit, you commit to repaying the borrowed amount plus interest gradually. Keep in mind that using credit will incur additional costs compared to cash payments. Responsible credit management can elevate your credit score, facilitating easier access to loans when necessary.

Dating back to the 1800s, credit reporting plays a vital role in today's lending sector. Lenders depend on detailed credit reports outlining your borrowing and repayment history. Financial institutions willingly share this data with major credit bureaus like Equifax®, Experian®, and TransUnion® to help determine lending risks and appropriate terms for loans.

Reports are comprised of:

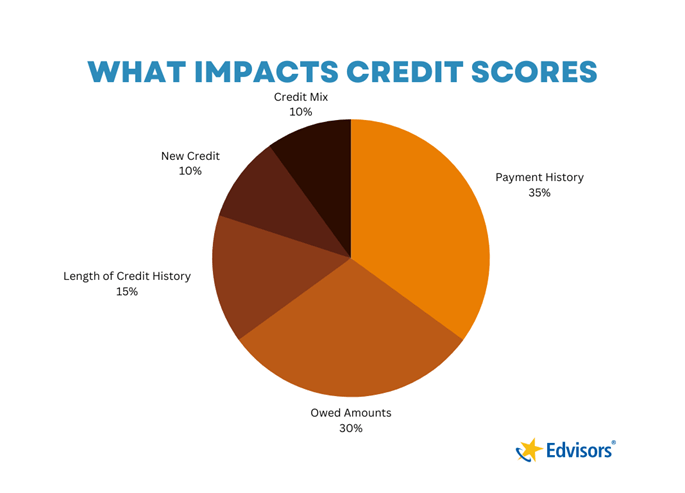

- Payment History—over the past seven years, did you make payments on time, late, or did you miss any completely?

- Amount Owed—how much money do you collectively owe on all of your credit accounts? This will look at your student loans, car loans, mortgages, private loans, credit cards, and measure it against your credit utilization (what percentage of your available credit did you use? Try to keep this to 30% or less)

- Credit History Length—how long have you had open lines of credit? Credit cards, even if you don’t use them regularly, and installment loans such as student loans can help establish a strong credit history length.

- New Credit—if you have opened a lot of new accounts (i.e., new credit cards, taken out a new car loan, etc.) in a short time span, your credit score might go down as it could indicate to potential lenders you are having difficulty paying for things. If you are hoping to take out a loan or mortgage in the near future, try to limit the number of lines of new credit you open.

- Variety of Credit—what kinds of credit do you have? A combination of revolving credit (credit cards and student loans can positively show you can manage multiple types of credit

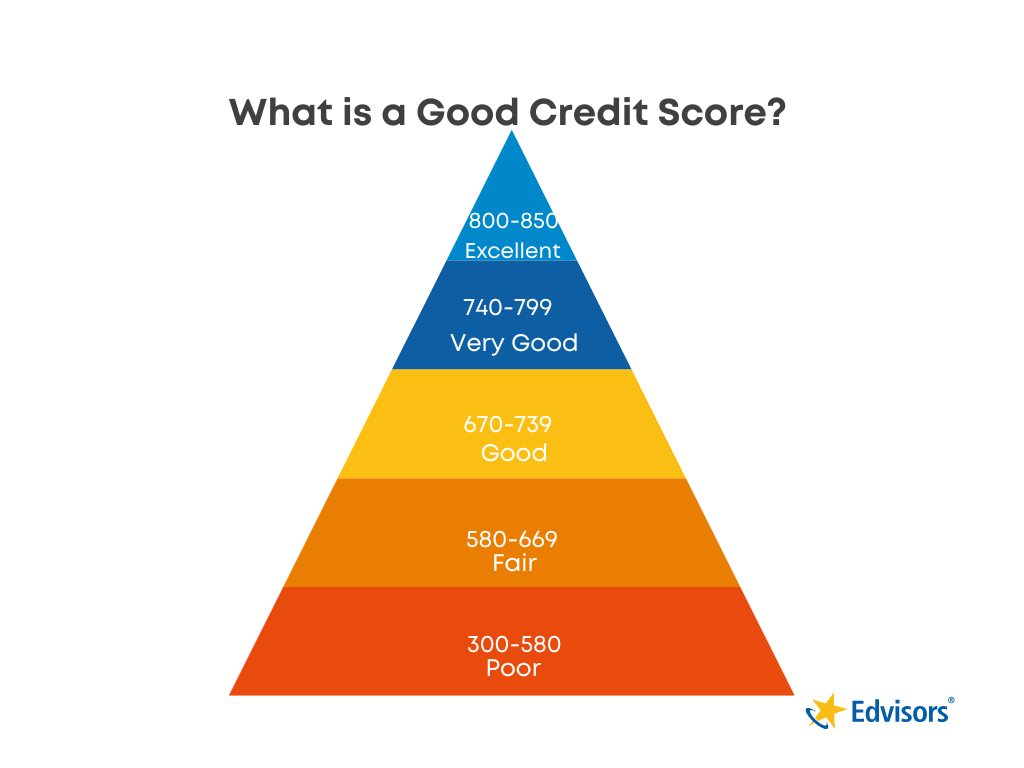

Your credit report is condensed into your credit score. Different groups such as Equifax, Experian, and TransUnion can score your credit differently, but overall they give higher scores to those who are statistically more credit worthy. A popular model is the FICO® Score which ranks borrowers on a 300-850 scoring system. FICO® Scores break down as follows:

Higher credit scores will enable you to receive lower interest rates and better loan terms, since they will consider you are a lower risk to lend to. Lenders will see you as a dependable and responsible borrower. FICO® reported as of August 2022, the average credit score was 716. For those aspiring credit overachievers, know that only about 1% of all scores reach 850.

Sponsored Ad

Why is Credit Important?

Your credit allows you to meet your financial goals as you progress through life. Having good credit is important because that is what enables you borrow money easier than those with poor credit. Your credit level will also determine how much the lender will allow you to borrow, and what kind of interest rate they will give you. Lower interest rates (for those with good to excellent credit) will mean you may be able to have lower monthly payments and end up paying less in interest.

Good credit can also help you get the loan or lease on the car you’ve been eyeing. It can help you get a mortgage with a lower interest rate. It can help you get an unsecured credit card with a lower interest rate and possible more perks. It may also help you lower your insurance rates (depending on your state), and landlords may ask to run your credit to screen potential renters.

2 Most Popular Types of Credit

When it comes to credit, there are different ways to borrow money based on your situation and circumstances. It's important to have a combination of various types of credit on your report as it can positively impact your credit score. However, it's crucial to be responsible with borrowing and avoid using credit that you'll struggle to repay just for the sake of having multiple credit lines. Take your time to build your credit gradually.

Installment Loans

Installment loans allow you to borrow a specific amount of money that must be paid off within a certain agreed upon period of time, usually through monthly payments. You will also have to pay any interest and/or fees in addition to the initial (or principal) amount of money. Some installment loans you may be familiar with are:

- Student loans

- Car loans

- Home loans (mortgages)

- Personal loans

Revolving Credit (Credit Cards)

Credit cards (also known as revolving credit) give you a maximum amount of money you can borrow (credit limit) and you are able to make purchases up to that limit. For any money you use, you agree to make a monthly minimum payment that is a combination of the money you borrowed plus interest. You can save money, if you pay off your credit cards in full each month to prevent interest from being applied to your balance. If you do happen to only make minimum payments, the remainder of the balance will continue to the next month’s statement and that outstanding amount leftover will be charged interest along with any new charges made during the month.

How to Build Credit

Building credit can sometimes seem counterintuitive, as you often need credit to establish credit. Contrary to popular belief, having a bank account is not always a necessity. By consistently making payments on installment loans like student loans, you demonstrate responsible borrowing habits that positively impact your credit score. Moreover, student loans contribute to the average age of your accounts and diversify your credit mix, further bolstering your creditworthiness.

The following chart shows what impacts your credit score and how much of an impact it has on your overall score:

Building Credit from Scratch

If you don’t have any credit at all and you want to build some, you may need a little assistance from a trusted family member who already has strong credit. Ask to become an authorized user on their account and allow their good credit to rub off on you! Even if you don’t use the account, just by being associated with their good credit will help grow your credit.

If being listed as an authorized user on someone’s account isn’t an option think about using a cosigner. You can apply for a credit card, car loan, or student loan with a responsible cosigner. A cosigner agrees to be legally responsible for the loan and pay back the money borrowed if you are unable to do so. Having a cosigner helps you qualify for loans that you may not be able to qualify for on your own.

If you are unable to get a credit card due to bad credit or no credit, try applying for a secured credit card. With a required upfront deposit, lenders will have the ability to use your deposit to cover your charges, if you don’t make your payments. This allows you to establish positive repayment behavior on your credit report and will help you build your credit score over time.

Build credit while you bank. Make credit simpler, safer, and seamless.

- Get paid up to 2 days faster with direct deposit

- Build credit everyday with purchases

- Savings can earn up to 4% APY

Read More: Best Credit Cards for Students

Building Stronger Credit

You may already have some credit established but would like to improve your current score. Keeping your score high has many benefits, but it is up to you to be aware and responsible for your overall financial health. If you’re looking to better your credit, it begins with your financial habits. The following tips will help you to be a more desirable borrower and improve your overall credit score:

- Pay your bills on time; if you are unable to make your payment in full, call and set up a payment plan prior to a bill being sent to collections (this is one of the biggest factors in determining your credit score)

- Keep your credit card usage (or credit utilization) to under 30% of your available credit

- Look over your credit report at least once a year to monitor for any suspicious activity such as fraud, identity theft, or other financial scams; using annualcreditreport.com gives you access to your free credit reports

- Review your monthly payments often and dispute any charges you don’t believe are accurate

- Keep your credit accounts open, even if you no longer use them (unless you experience high fees, or poor service) as they can help the average age of your credit

Credit is a valuable part of your financial well-being. Making smart and careful decisions can impact you now as well as impact the choices you will be able to make in the future.