Summary: Direct Stafford Loans, also called Stafford Loans, are federal student loans offered to both undergraduate and graduate students. Students in undergraduate programs receive a 6.39% interest rate. A 1.057% origination fee is taken from the loan amount before the funds are sent to the school.

- Federal student loans for undergraduates include both subsidized and unsubsidized loans offered by the Department of Education.

- Subsidized loans are exclusively offered to students showing financial need, whereas unsubsidized loans are accessible without regard to financial need.

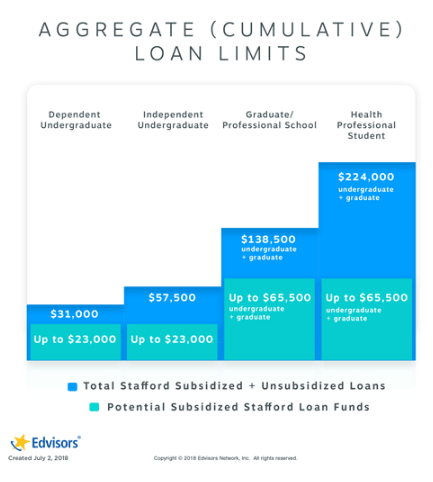

- Aggregate loan limits for Direct Stafford Loans are based on the student’s dependency status, program, and if they are an undergraduate or graduate student.

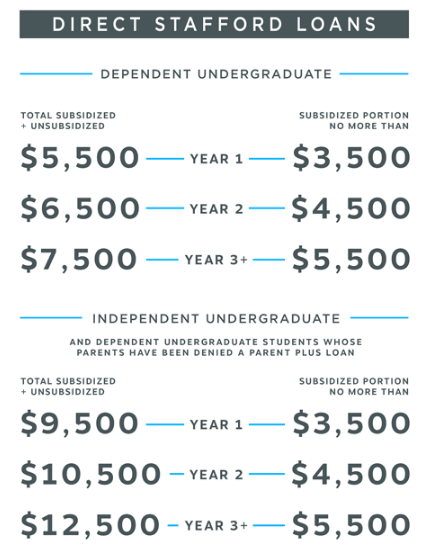

- Annual loan limits for an undergraduate student are up to $7,500 for a dependent student, and up to $12,500 for an independent student.

- Aggregate loans limits for undergraduate students are up to $31,000 for a dependent student, and $57,500 for an independent student.

- Repayment terms vary depending on the type of loan and program chosen; options include standard repayment, extended repayment and income-driven plans.

Federal Student Loans

Undergraduate students are eligible for federal Direct Stafford Loans, which are offered by the federal student aid program. Direct Stafford Loans (sometimes just called Stafford Loans or Direct Loans) are low-cost, fixed-rate federal student loans available to undergraduate and graduate students. Direct Loans offered to undergraduate students are the most common and among the lowest-cost loans available.

In the Direct Loan program, your lender is the U.S. Department of Education (ED). However, your loan will be managed by a federal student loan servicer. Your loan servicer will be your primary contact if you ever have questions about your loan. Your servicer will also be mailing (or emailing) you information regarding your federal student loans. Once you enter repayment, you will make payments to your loan servicer.

Types of Federal Student Loans

Undergraduate students may be eligible for two types of Direct Stafford Loans:

- Direct Stafford Unsubsidized Loan (not need-based)

- Direct Stafford Subsidized Loan (need-based)

Note: If you’re an undergraduate student and your parent would like to help you pay for college, but they need to borrow a loan, they may be eligible for a federal Direct Parent PLUS Loan, or a private student loan (private student loans are not part of the federal student loan program).

Subsidized vs. Unsubsidized Loans

The main difference between a Direct Subsidized Loan and a Direct Unsubsidized Loan, is that a Direct Subsidized Loan is considered a need-based loan, which is a loan based on your or your family’s financial circumstances. This matters when it comes to how much money you qualify for, along with who pays the interest on your loan. For subsidized loans, the U.S. Department of Education will pay the interest on your behalf while you are in school, during your grace period and during any deferments. For unsubsidized loans, you are responsible for the interest on your loans.

Federal Subsidized Loans

A Direct Subsidized Loan is a need-based loan. Your school will be the one to determine if you have financial need (based on your school’s determined cost of attendance, your expected family contribution, as well as the other financial aid offered to you). If your school has determined that you have financial need, they may award you a Direct Subsidized Loan. However, if your school determines that you do not have financial need to attend their school, there’s no way to apply for this type of loan. If you think you should have received a subsidized loan and there was a mistake made on your financial aid determination, you need to talk to your financial aid advisor. Graduate students are not eligible for subsidized loans. You must be an undergraduate student to qualify.

A Direct Subsidized Loan is known to offer the most beneficial terms for undergraduate student borrowers.

Here are some key details about this type of student loan:

- Interest will be paid by the U.S. Department of Education:

- While you're in school and are considered enrolled at least half-time

- During your six-month grace period (your grace period begins when you graduate or drop below half-time enrollment)

- During authorized periods of deferment while you're in repayment

- Interest rates tend to be low for undergraduate students

- For award year 2025 - 2026 the interest rate is 6.39%

- The loan has low origination fees

- For federal student loans first disbursed on Oct. 1, 2024 through Sept. 30, 2025: 1.057%

Federal Direct Unsubsidized Loans

A Direct Unsubsidized Loan is not a need-based loan. This means your or your family’s income is not a factor when awarding this type of loan. In fact, your school won’t even use your expected family contribution (as determined by the FAFSA) when it comes to including this type of loan in your financial aid package.

Keep in mind, your school is still limited to only awarding you up to the cost of attendance (determined by your school) minus other aid received.

Here are some key details about unsubsidized federal student loans:

- Interest is not paid for by the U.S. Department of Education while you’re in-school, during your grace period, or during authorized period of deferment. You are responsible for accrued interest from the time the loan is disbursed.

- Interest rates tend to be low for undergraduate students

- For award year 2025 - 2026 the interest rate is 6.39%

- This loan does have origination fees

- For loans first disbursed on Oct. 1, 2024 through Sept. 30, 2025: 1.057%

Federal Student Loan Interest Rates and Fees for Undergraduate Students

| Loan Type | Interest Rate | Loan Fees |

|---|---|---|

| Direct Stafford Subsidized Loan | 6.39% (for loans first disbursed July 1, 2025 through June 30, 2026) |

1.057% (for loans first disbursed Oct. 1, 2024 through Sept. 30, 2025) |

| Direct Stafford Unsubsidized Loan | 6.39% (for loans first disbursed July 1, 2025 through June 30, 2026) |

1.057% (for loans first disbursed Oct. 1, 2024 through Sept. 30, 2025) |

| PLUS Loan for Parents | 8.94% (for loans first disbursed July 1, 2025 through June 30, 2026) |

4.228% (for loans first disbursed Oct. 1, 2024 through Sept. 30, 2025) |

How to Apply for Federal Student Loans

If you are interested in borrowing a federal student loan, you need to complete the Free Application for Federal Student Aid (FAFSA®). Along with federal student loans, by completing the FAFSA, you are applying for federal grants, as well as state and institutional grants and scholarship opportunities.

You are eligible to file the FAFSA in October of each year for the next term starting the following July. (Yes, you can file the FAFSA almost a year before school starts). It’s always recommended that you complete the FAFSA as soon as possible in order to qualify for as much free money as possible—that way you can borrow as little as possible.

Federal Student Loan Eligibility

You're likely eligible to receive a federal student loan if you:

- Meet the eligibility criteria for federal student aid

- Successfully complete the FAFSA

- Have not reached your annual or aggregate loan limits

- Are not in default on a federal student loan

It is up to your school to determine which federal student loans may be available to you, and the amounts you are eligible to receive.

Federal Student Loan Limits

There are limits on the amount of Direct Subsidized and Direct Unsubsidized Loans that you are eligible to receive each year (annual) and in total (aggregate).

Here’s what you need to know, just because there are annual and aggregate loan limits doesn’t mean you will be awarded loan funds up to that limit. Your school can’t award you financial aid funds in excess of your school’s determined cost of attendance for the academic year. Loan amounts tend to be determined last, after your school has determined the other types of aid you are eligible for, like grants and scholarships.

Annual Loan Limits

Depending on what academic year you are in and your FAFSA dependency status, the maximum amount of Direct Subsidized and Direct Unsubsidized Loans will be from $5,500 to $12,500.

Undergraduate students in their first two academic years are eligible for slightly lower maximum student loan amounts in loan funds than their upperclassman peers. Also, if you are a dependent undergraduate student (as determined by the FAFSA), you will have a lower annual loan limit than an independent undergraduate student. Unless you qualify for a dependency override, in order to qualify for increased loan limits, your parent will have to first be denied a Parent PLUS loan. The denial is needed each academic year for your financial aid office to offer the higher loan amounts (those of an independent student).

Maximum Eligibility for Subsidized Loan Funds

If you received your first Direct Subsidized loan disbursement after July 1, 2021, there is no set time limit for loan eligibility under your program. However, if you were a first-time borrower between July 1, 2013, and July 1, 2021, a maximum eligibility period was enforced - not exceeding 150% of your program's duration at enrollment. For example, in a four-year degree program, the extended period to receive Direct Subsidized loans would be six years (150% of four years).

If you received your first disbursement of Direct Subsidized loans on or after July 1, 2021, there is no time limit on how long you can continue to receive a loan for your program. However, if you are a first-time borrower who obtained their initial student loan between July 1, 2013 and July 1, 2021, there was a maximum eligibility period in place. This period was set at no more than 150% of the published length of the program you were enrolled in at that time.

For example, if you were enrolled in a typical four-year bachelor's degree program, the maximum period you could receive Direct Subsidized Loans would be extended to six years, which represents 150% of the standard program length.

Aggregate Loan Limits

Another loan limit you need to be aware of, is the aggregate (total) loan limit on Direct Subsidized and Direct Unsubsidized Loans. If you are a dependent undergraduate student you can only borrow up to $31,000 of which no more than $23,000 can be subsidized federal student loans.

If you are an independent undergraduate student you can only borrow up to $57,500 of which no more than $23,000 can be subsidized loans.

If you go back to school to continue graduate studies, your aggregate loan limits increase to $138,500 (or $224,000 if you are a health professional student), of which no more than $65,500 can be subsidized loan funds. As a graduate student, your undergraduate and graduate borrowing are both included in this total.

Reached Aggregate Student Loan Limit?

If you don’t see a Direct Stafford Loan in your financial aid package; and you’ve been in school for some time, the reason you aren’t eligible could be because you have reached your aggregate loan limit. If this is the case, it’s time to have a discussion with your financial aid office so they can explain your student loan options.

Here are two options if you still need help paying for college:

Option 1: Federal Parent PLUS Loan

If you’re a dependent undergraduate student, even if you’ve reached your Direct Stafford Loan limits, your parents may be able to borrow a federal Parent PLUS loan to help cover your college costs. Of course this requires your parent to apply, qualify, and borrow money they will be responsible to repay. It is up to your parent(s) to decide if they want to borrow money to help you pay for college.

Option 2: Private Student Loan

There are private student loan options to help you pay for college. However, this route may not be that easy. If you don’t have any credit history and are unable to demonstrate at least two years of work history, you may not qualify for a private student loan unless you apply with a creditworthy cosigner. A private student loan may also be a viable option if you are an international student and don't qualify for federal loans.

More>>> International Student Loans

Another option with private undergraduate student loans is for your parent to apply for a private parent student loan to help you pay for college. Your parent will have to be willing and will need to pass the credit check or apply with a creditworthy cosigner.

How Do Federal Student Loans Work?

As mentioned before, you will need to file the FAFSA in order to be considered for federal student loans. Once filed, your school will determine your federal student loan eligibility after they determine your eligibility for other types of aid that you don’t need to repay (free money) such as grants and scholarships.

Important numbers you should know:

- Expected family contribution. This is the number determined by the FAFSA which is used by your school to award you need-based financial aid.

- Cost of attendance (aka student budget). Your school determines the cost of attendance by determining how much it would cost a student to attend school for the academic year. They may have different costs of attendance depending on your enrollment status (full-time, half-time, part-time, etc.), and your living situation (are you living on-campus, off-campus, or with family). Your cost of attendance includes more than just tuition and fees. It could include housing, meals, transportation, books and supplies, etc. Your school should clearly outline what they consider to be part of your costs of attendance.

How is Need-Based Aid Determined?

Your school will first take your expected family contribution and subtract it from your cost of attendance. They will then award you with need-based aid, starting with the grants and scholarships you are eligible for. If you still have financial need, they will then award you a Direct Subsidized Loan.

How is Non-Need-Based Aid Determined?

Once your school has determined your need-based award, now it’s time to determine your non-need-based aid. Your school will take your cost of attendance and subtract all the financial aid you have been awarded so far. Your school will then begin to determine your eligibility for non-need-based aid, like a Direct Unsubsidized Loan.

Keep in mind, your school may not award you enough aid to cover your tuition costs or the cost of attendance.

If you are in a situation where you need to seek additional funding, you should sit down with your financial aid office. You should also seek out additional scholarship opportunities to help you pay your tuition.

If you are a dependent undergraduate student and still have a financial aid gap, your school may suggest your parent look into borrowing a Direct PLUS loan for parents or a private parent student loan. You could also look at private student loan options, but you will likely need a creditworthy cosigner to help you qualify. Of course, Direct PLUS Loans or private student loans are not an option for every family.

However, if you or your parent want to borrow additional funds, then it’s time to have an honest discussion. If you determine you are able and have a need to borrow every year to complete your program, do your research. It may be worth it to compare federal and private student loan options.

What Can Federal Student Loans Be Used For?

Federal student loans may be used for education-related expenses, including:

- Tuition fees and other enrollment costs

- Room and board

- Off-campus housing

- Groceries and meals during the school year

- Textbooks and supplies

- Computers and equipment necessary for class

- Transportation to school

- Childcare expenses related to school activities

Students may also use federal loans to help pay for certain personal expenses, but keep in mind that student loans are intended to pay for college—not frivolous spending. Avoid using your student loans on things like expensive clothing, fine dining, vacations, or paying off credit cards. While no one is tracking what you spend your student loan funds on, if you use federal loans to cover non-education-related expenses, you may not have enough money to pay for college in the future—or the option to borrow more. In the unlikely event that your financial aid office does discover you’ve used funds inappropriately, you may be investigated for student loan abuse. If found guilty, you would have to pay back funds retroactively, including any funds already spent. Your cosigner can also be held responsible.

The simple answer here is, yes. Here are some reasons why you could be denied federal student loans:

- You have reached either your annual or aggregate loan limits

- You are not eligible to receive federal student loans because you have received other types of aid (like a scholarship) up to your cost of attendance

- If you indicate to your financial aid administrator that you have no intention to repay the loan according to the terms of the Master Promissory Note, they may be able to prevent you from borrowing federal student loan funds. They will need to document the situation.

- You have a federal student loan in default.

- If your parent is seeking to borrow a Parent PLUS loan, they will need to pass a credit check and could be denied if they’re found to have adverse credit history, as defined by the U.S. Department of Education. Note: Parent PLUS loans and private student loans do not have the same credit requirements. Just because you were denied for one, does not mean you will be denied for the other.

How to Accept Student Loans?

When you get your financial aid package from your school, you may be required to accept or deny any awards you may have received; this includes loans. Make sure you read the directions carefully. Schools use two different methods: active and passive acceptance of financial aid.

If your school uses the active method, you will need to complete an action affirming all the financial aid you want to keep. You have the option here to reject, modify or accept, the aid being offered to you. If you do not accept your financial aid by the deadline provided by your school, your school may consider their financial aid package rejected. Chances are they will reach out to you if you are getting too close, or worse, pass the deadline. But this is why it’s important to read the directions of your financial aid package carefully. It will save you a headache of fixing an issue you could have avoided.

If your school uses the passive method, you will only need to indicate if there are any awards you want to modify or reject. If you take no action your school will make the assumption you want all the financial aid being offered to you. Schools with a passive method will also have deadlines for package modifications. Even though you can probably make changes after the deadline, it may not be as easy (or clean) of a process after your school’s deadline.

Do You Have to Accept Student Loans?

You can influence your financial aid package, regardless of your school's method. But why would you consider reducing or rejecting an undergraduate student loan? The total cost at your school might exceed what you actually owe. If you have savings, plan to live at home, or intend to work while studying, you could lower or eliminate the need for borrowing money. It's advisable to borrow only what you truly need, even with favorable terms like federal student loans – remember, loans must be repaid with interest.

Now what happens if you reject a federal student loan and run into trouble later in the term? You can actually go back to the financial aid office and request your loan funds.

How Are Federal Student Loans Disbursed?

A disbursement is essentially the payment of money from the source. When it comes to federal student loans, in most cases, the U.S. Department of Education will send (disburse) your loan funds to your school directly. From there your school will apply the funds to your student account and then let you know if you have any money leftover after paying the money you owe the school first—this is known as a credit balance. When can you expect your money? Your school should have a disbursement schedule online or available upon request. For your information regarding the disbursement process for federal student loans and other aid, we highly recommend you check out our blog which talks about financial aid disbursement.

If I Accept a Student Loan, Can I Cancel It?

If you accepted your federal student loans and realized you didn’t need those funds, you can return them within the 14-day window after your school has informed you about your right to cancel. You should contact your financial aid office as soon as possible. If you cancel your student loan within your right to cancel window, you won’t be charged any fees or interest.

Now, if you miss your 14-day window, but your loan has yet to be disbursed, you want to contact your school with a written request to cancel your federal student loan. If you wait to submit your written request 30 to 120 days after your loan is disbursed, it can get a bit tricky because federal student loan cancellation will be up to your school’s discretion.

If you miss the 120 day deadline, or your school won’t process your request, you can still return the money. The best way to do this is to pay it back to your student loan servicer. This method will not eliminate the interest and fees that have already accrued (added up) on the loan, but it will save you money in the long run by not allowing additional interest to accrue.

Federal Student Loan Repayment

Any time you borrow money, you need to understand the terms of repayment. When it comes to federal student loans, you have a lot of options and flexibility.

Types of Federal Student Loan Repayment Plans

There are about 10 federal student loan repayment plans and options. Many of them are similar. Here is a brief description of the various student loan repayment options. For a more detailed description see our repayment plan page.

Standard Repayment: This is a 10-year student loan repayment plan. This is the repayment plan you will be automatically placed in if you don’t choose another plan. Under this plan, you will repay your loan in 10 years with fixed (unchanging) monthly payments. This is the fastest repayment plan and you will repay the least amount in total (because you will accrue less interest). Loan payments under this repayment plan do count towards Public Service Loan Forgiveness.

Example: If you had $50,000 in federal student loan with a 5% interest rate, your monthly student loan payments would be about $530 under a standard repayment plan.

Graduated Repayment: This is a 10-year repayment plan. Under this plan, you will repay your loan within 10-years. However, your loan payments will start small and increase every two years. This is a great repayment plan if you’re just starting out and expect to earn more money over time. Payments under this plan do not count towards Public Service Loan Forgiveness.

Example: If you had $50,000 in federal student loan with a 5% interest rate, your monthly payments would start around $300 and your last payments will be around $900 under a graduated repayment plan.

Extended Repayment: This is a repayment plan that extends your repayment up to 25 years. You can have payments fixed (unchanging) or graduated so they start small and increase every two years. This repayment option usually results in a cheaper monthly payment without repaying under an income drive repayment plans. However, it will result in you repaying a higher total amount. Loan payments made under an extended repayment plan do not count towards Public Service Loan Forgiveness.

Example: If you had $50,000 in federal student loans with a 5% interest rate, your loan monthly payments under a fixed extended repayment plan would be about $292. Under a graduated extended repayment plan, your student loan payments would start around $208 and your last payment will be around $476.

Income-Driven Repayment Plans: The federal government offers four repayment plans that base your monthly payment on your income and not your outstanding loan balance. They are all very similar but each has slightly different terms, conditions, and eligibility requirements.

Most income-driven repayment plans, with the exception of income-based repayment, are options only for federal Direct Loans made to students.

Direct PLUS loans made to parents are only eligible to be repaid under an income-driven repayment plan if they are consolidated into a Direct Consolidation Loan and then repaid under an income-contingent repayment plan.

Borrowers with Federal Family Education Loan Program loans can either choose to repay under an income-based repayment plan, or consolidate their loans into the Direct Loan program.

All student loan payments made under an income-driven repayment plan will count towards Public Service Loan Forgiveness.

- Income-Based Repayment (IBR): This student loan repayment plan will set your payments to 10 to 15% of our discretionary income (depending on when you borrowed your first loans). After 20 to 25 years of eligible payments, any amount outstanding will be forgiven.

- Example: If you had $50,000 in federal student loans with a 5% interest rate, were single, had a family size of 1 with an income of $40,000, and you were eligible to cap your payments at 10% of your discretionary income, your monthly payments would be about $174 for 20 years. Your student loan payments would increase or decrease depending on your income, marital status, and family size.

- Revised Pay As You Earn (REPAYE) Repayment: This student loan repayment plan will set your payments to 10% of your discretionary income. After 20 to 25 years of eligible payments any remaining balance will be forgiven – 20 years for loans borrowed for undergraduate study and 25 years for loans borrowed for graduate or professional study.

- Example: If you had $50,000 in federal student loan with a 5% interest rate, were single, and had a family size of 1, with an income of $40,000, your monthly payments would be about $174 for 20 years. Your student loan payments would increase or decrease depending on your income, marital status, and family size.

- Pay as You Earn (PAYE) Repayment: This repayment plan will set your payments to 10% of your discretionary income. After 20 years of eligible payments any remaining balance will be forgiven. This repayment plan is limited to new Direct Loan borrowers, borrowing on or after Oct. 1, 2007.

- Example: If you had $50,000 in federal student loan with a 5% interest rate, were single, and had a family size of 1, with an income of $40,000, your monthly payments would be about $174 for 20 years. Your student loan payments would increase or decrease depending on your income, marital status, and family size.

- Income-Contingent Repayment (ICR): The eldest of the income-driven repayment plans. This plan will set your payments to 20% of your discretionary income. It can be used to repay Direct Consolidation Loans which may include a Parent PLUS loan. After 25 years of eligible payments, any outstanding amount will be forgiven.

- Example: If you had $50,000 in federal student loans with a 5% interest rate, were single, and had a family size of 1, with an income of $40,000, your monthly payments would be about $384 for 25 years. Your payments would increase or decrease depending on your income, marital status, and family size.

Direct Consolidation: Consolidation is actually a student loan repayment option. If you have multiple loans you can combine them together and keep them in the federal student loan program with a Direct Consolidation Loan. Direct Consolidation Loans are eligible for the federal student loan repayment options, as long as all appropriate criteria is met for each plan.

There are a few things to note (of course). Your extended repayment option may allow you to extend your repayment to up to 30 years depending on your total education debt (this will take into consideration any federal and private student loan debt you have). If you extend your repayment to 30 years, your monthly payments may be more affordable, but you will repay more in total.

Although the process is similar to a traditional loan refinance, a consolidation in the federal program will not allow you to qualify for a competitive interest rate on your loans. The interest rate on your Direct Consolidation Loan will be based on the weighted average of the loans you are consolidating.

Private Student Loan Refinance: This is an option for both federal and private student loans. A private student loan refinance will allow you to choose a lender you want to work with, and qualify for a new loan with a competitive interest rate.

With COVID-19 driving down private student loan interest rates, you may even be able to find a lower interest rate than your current federal loans offer. Reducing your interest rate can allow you to significantly reduce the interest you’ll pay over the life of the loan, leaving you more money to pay for personal expenses while in school. If your federal student loans are being offered COVID-19 relief , you can start researching now and come up with a plan to re-enter repayment in February 2022.

This is not an option for borrowers who are seeking loan forgiveness under the federal student loan program, and private student loans don't qualify for federal student loan repayment options. Because you will be working with a private lender, you will need to pass a credit check or apply with a creditworthy cosigner.

Statute of Limitations on Student Loans

As you can probably tell, the repayment terms for some of these undergraduate loans are rather long. Some people also have a significant amount of loan debt, and may find it challenging to repay their loans. When it comes to federal student loans, the debt collection is a bit different. There is no statute of limitation on federal student loans, and they are difficult to have discharged in bankruptcy. Meaning, if you have federal student loans, it’s best to find a way to repay them.

If you’re having trouble repaying, you need to contact your loan servicer. They can let you know if there are repayment options available to you, or if you qualify for a loan payment postponement (deferment or forbearance).

Learn More About Undergraduate Student Loans

Best Private Student Loans July 2025