When filling out the FAFSA® you’ll be identified as either a dependent or independent student. This distinction is important because it impacts your financial aid eligibility. Dependent students are required to include their parents' demographic and financial details on their FAFSA, while independent students need to provide their own financial information. If you’re married, you’ll also need to include your spouse’s financial details in the application.

FAFSA Dependency Questions

The FAFSA will ask you a series of questions to determine your dependency status. The questions are pretty much ‘yes’ or ‘no’. Technically, there are 10 questions, but if you are completing your FAFSA online, it will only ask you questions based on the information you provided up until that point.

For example, you may not see a question asking you to confirm if you will be 24 years old or older by Jan. 1 of the school year for which you’re applying for financial aid. When you log into the FAFSA application, you will use your FSA ID username and password. Your FSA ID profile, on StudentAid.gov, includes your date of birth and social security number. The information from your FSA ID is used to populate some of your student demographic information, and based on your date of birth, the online application can determine your age.

The questions you may see on the 2025-2026 FAFSA

- Were you born before Jan. 1, 2002?

- As of today, are you married? (Also answer “Yes” if you are separated but not divorced.)

- At the beginning of the 2025-2026 school year, will you be working on a master’s degree or doctorate program (such as a MA, MBA, MD, JD, PhD, EdD, graduate certificate, etc.)?

- Do you have, or will you have children who will receive more than half of their support from you, between July 1, 2025 and June 30, 2026?

- Do you have dependents, other than your children or spouse, who will receive more than half of their support from you, between July 1, 2025 and June 30, 2026?

- Are you currently serving on active duty in the U.S. Armed Forces of purposes other than training?

- Are you a veteran of the U.S. Armed Forces?

- At any time since you turned 13, were both your parents deceased, were you in foster care, or were you a dependent or ward of the court?

- As determined by a court in your state of legal residence, are you or were you an emancipated minor?

- Does someone other than your parent or stepparent have legal guardianship of you, as determined by a court in your state of legal residence?

- At any time on or after July 1, 2024, did you receive a determination that you were an unaccompanied youth who was homeless, or were self-supporting and at risk of being homeless?

Why does FAFSA consider me dependent?

If you answer ‘no’ to all these questions, you are going to be considered a dependent student for FAFSA purposes. In most cases, if you are an undergraduate student, under the age of 24, single with no children, you will likely be classified as a dependent student for FAFSA purposes.

If you are required to provide parental information, but there are reasons why you can’t provide it, you will be given the opportunity to indicate this.

Who is a FAFSA Contributor?

If you are a dependent student for FAFSA purposes, you will need to provide parent information on your FAFSA.

If you are an independent student for FAFSA purposes, and you are married, you will be required to provide the information of your spouse.

If you are an independent student for FAFSA purposes, and you are not married, you will not have any FAFSA Contributors.

ALL FAFSA Contributors are required to have an FSA ID in order to provide their information on your FAFSA.

Potential FAFSA Contributor, Dependent Student

If your parents are married, or live together, you will provide information for both parents. If your parents filed their tax returns jointly, only one parent will need to be a FAFSA contributor. If your parents filed their taxes separately, both parents would be considered FAFSA Contributors, and they will both need to provide information on your FAFSA.

If your parents are not married, are separated, and do not live together, you will need to determine who your FAFSA parent is. For some families, it may not be entirely clear which parent’s information to provide. Click here if you need help determining your FAFSA parent is. Once you determine who your FAFSA parent is, that parent will be a FAFSA Contributor. If that parent is remarried, and filed a separate tax return from their spouse, your FAFSA parent's spouse will also be a FAFSA Contributor on your application.

If your parent is refusing to provide information, we have some tips to help you.

Potential FAFSA Contributor, Independent Student

If you are determined to be independent for FAFSA purposes, and you are married, you will need to include information regarding your spouse on your FAFSA. If you and your spouse did not file a joint tax return, meaning you filed your taxes separately, your spouse will be a FAFSA Contributor on your FAFSA.

Does it matter who claims a child on taxes for FAFSA?

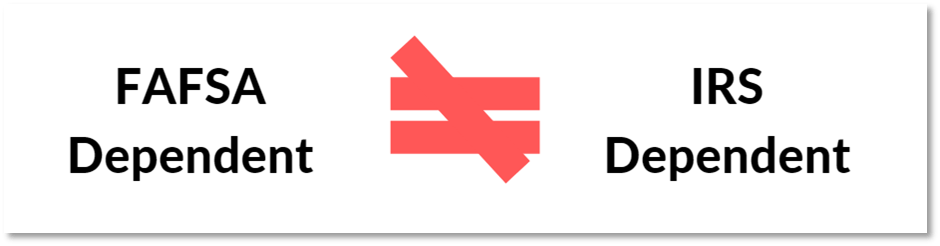

NO. Sorry for the caps, but we want to make sure you don’t miss this answer. Your dependency status has nothing to do with whether your parent claims you on their tax return. In addition, if the FAFSA determines that you are a dependent undergraduate student, it does not matter which parent claims you on their taxes. If you are a dependent student, and both of your parents don’t live together, you would need to determine which parent’s information to include. This parent may not be the parent who claims an exemption on their tax return.

It also doesn’t matter if neither parent claims you on their taxes and you file your own taxes. If the FAFSA has determined you to be a dependent student for FAFSA purposes, it will ask you to provide parental information.

FAFSA Dependency Tax Exemption

Just to be clear, being classified as a dependent for FAFSA purposes is not the same as being claimed as an exemption or dependent on a parent (or other individual's) taxes. These terms are similar and can be easily confused. But the FAFSA will determine your dependency status based on the way you answer the dependency status questions.