Have you recently enjoyed a meal out but then felt a tinge of regret after paying the bill? That feeling is known as the “pain of paying” — a phenomenon you should experience whenever you spend money on something. However, a growing number of digital payment methods not only reduce that pain but cause you to feel pleasure instead. While that might sound like a great thing, it can lead to some serious financial problems. Here’s a closer look at the how digital payment methods are influencing spending and four tips that can help you stay in control.

How Much is Cash Usage Decreasing and Why Does it Matter?

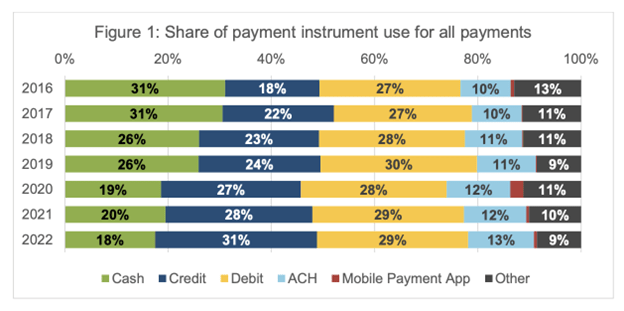

Do you keep cash in your wallet? Overall, the number of people who do is decreasing. Between 2016 and 2022, cash payments amongst U.S. consumers dropped from 31% to 18%, according to the 2023 Findings from the Diary of Consumer Payment Choice report by the Federal Reserve. During that same time, credit card payments increased from 18% to 31%.

Source: Federal Reserve

The COVID-19 pandemic fast-tracked the move away from cash, but there’s also a range of convenient new payment methods luring in younger, tech-savvy consumers. According to the 2023 U.S. Consumer POS Payment Program report by J.D. Power, the average American now uses about four different payment methods, which can include:

- Debit cards (78%)

- Cash (74%)

- Credit cards (66%)

- Digital wallets (Cash App, Apple Pay, Google Wallet, PayPal, Venmo, etc.) (36%)

- Gift cards (33%)

- Buy Now, Pay Later (33%)

- Merchant apps (20%)

- Checks (19%)

- Prepaid cards (14%)

- Pay by bank (7%)

- Cryptocurrency (3%)

But why does the shift away from cash and into digital payments matter to you?

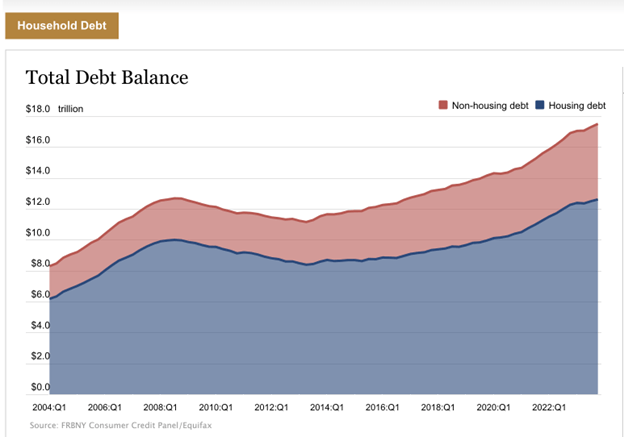

Well, along with the growth in digital payments, there’s also been a significant upward trend in debt. At the end of 2023, the total U.S. household debt was $17.5 trillion — up from $5.51 trillion at the end of 2000, according to the Federal Reserve. So, the underlying question is — do digital payment methods encourage you to overspend?

Source: Federal Reserve

Do People Spend More with Debit and Credit Cards or Cash?

There’s no question that cards and digital money make transactions easier than paying with cash. You can tap your card or smartphone within seconds and avoid the need to carry, count, and exchange physical money. But what’s the cost of that convenience?

Debit Cards vs Cash

As it turns out, people do tend to spend more when using a debit card instead of cash. Researchers in a 2016 study found that participants were willing to pay 22% to 54% more for items when paying with a debit card versus cash. Further, a 2011 study found that participants using a debit card were willing to donate more than those who donated using cash.

But why when both payment methods immediately deduct the amount from your available balance? Researchers say it could be because you experience a larger pain of payment with cash due to the physical loss of money. With a debit card, you don’t get that immediate negative feedback unless you check your bank account balance. Further, the presence of credit card logos has been found to result in a higher willingness to pay, so could play a role as they are often present on debit cards.

Credit Cards vs Cash

Credit cards have also been found to increase consumer spending in a variety of studies as they cause a reduced level of transparency, a lower pain of paying, and the decoupling of the payment and transaction.

What does that mean, exactly?

Shopping with a credit card can feel like you’re not spending real money because you don’t have to pay for purchases in the moment. Instead, you make the purchase, get the instant gratification, and worry about the payment later. Additionally, purchases often get lumped in with a larger balance, disguising the “pain” of a particular payments.

Shopping with credit cards has also been found to do more than just reduce pain. Researchers in a 2021 study used fMRI technology to look at the brain activity of people as they made purchases with cash and credit cards. The findings revealed that credit cards sensitized the brain’s reward networks, motivating greater spending in shoppers.

Do the New Digital Fintech Products Make Overspending Worse?

So, both debit and credit cards encourage greater spending than cash, but what about the newer digital fintech products like digital wallets and Buy Now, Pay Later (BNPL) loans? Are they also driving people to spend more? In short — yes. If a financial product is making it easier to make purchases and pushing the pain of payment further out of sight, it’s likely going to entice you to spend more.

For example, two 2022 studies found that mobile payments effectively enhanced purchase likelihood due to both a reduction in the pain of paying and an increase in a pleasure of paying. Another 2020 study came to a similar conclusion, finding that mobile payments can increase the willingness to pay more than other payment methods due to their added convenience.

As BNPL services, they’re extremely powerful because they combine the benefits of credit cards, convenient online payments, and interest-free payment plans. In a recent survey of U.S. consumers who use BNPL, McKinsey found that 12% of respondents said BNPL helped them make purchases they wouldn’t have otherwise made, while 19% said it allowed them to spend more.

How Can You Control Your Spending When Going Cashless?

While digital payment methods are making it easier and more enjoyable to spend money, the underlying reality hasn’t changed. With every swipe, tap, or click, you’re pulling from a limited supply of money. Once the money’s gone and the feel-good chemicals in your brain have worn off, you’ll still be left with a lower bank balance or a debt owed. So how can you stay in control of your money and prevent impulse spending?

1. Create a Budget and Goals

Make a plan for your money. Take note of all of your income and expenses so you know how much you have left over each month. From there, have some fun and decide how you want to spend your discretionary income. For example, perhaps you split it between saving for a car, going out with friends, and investing in a retirement fund. You’ll be less tempted to impulse spend when you have goals you care about and a plan to achieve them.

2. Feel the Pain of Payments

When you make a purchase, you should feel the pain of it. Why? Because every purchase comes at a cost. The pain allows you to reflect on if a cost is worth the reward and inform future decisions. But when you ignore the cost or defer it, you can lose touch with what you value and the value of money. So no matter how you pay, check your balance afterward. Take note of exactly how much you spent and the work that was required to make that amount. For example, if you make $25 per hour and just spent $50 on a new shirt, consider if it was worth two hours of work.

3. Use Credit to Your Advantage

Credit can help or hurt you. Use it as a tool that works in your favor. For example, you can build a positive credit line by using a no-fee rewards credit card to pay for your regular expenses and paying it off in full each month. On the other hand, you can quickly dig yourself into a hole by using a credit card to splurge on shopping trips and nights out that your income can’t cover.

4. Be Aware of Why Digital Payments and Using Credit Feels Good

Lastly, knowledge is power. It’s important to understand that using digital payment methods triggers the same reward centers in your brain that are activated by gambling, addictive drugs, and sugar. Spending what feels like “free money” and ignoring your bank balance may feel good in the moment but causes serious problems over time. You’ll be much better off in the long run if you keep tabs on your budget, set goals, and stick to your plan. A small impulse buy here or there can be fine, as long as it’s the exception and not the rule.

Frequently Asked Questions About Digital Payment Methods

Still have questions about digital payment methods? Here are answers to some common questions.

Do people spend less when using cash?

Yes, a variety of studies have found that people tend to spend less money when they’re paying with cash versus credit cards, digital wallets, or even debit cards.

Why do people use credit cards more than cash?

People prefer credit cards over cash for a variety of reasons such as the convenience, ease of recording transactions, and ability to put off costs until later.

How much more do people spend with cards than cash?

Participants in a 2016 study were willing to pay 22% to 54% more for items when paying with a debit card versus cash.

When will digital currency replace money?

The Federal Reserve hasn’t shared any plans to replace cash with a central bank digital currency (CBDC), but it is considering implementing a digital currency to supplement cash payment options.

How many people use cash instead of cards?

In 2022, cards were used for 60% of all payments while cash was used for just 18%, according to a study by the Federal Reserve. In comparison, cards were used for 45% of all payments while cash was used for 31% in 2016.