Ask just about any high school kid how to ensure financial success as an adult and most will tell you getting a college degree is the first step on that journey. A common mindset prevails that a college degree opens the door to a career and a career is key to financial success. Not many would disagree with this line of thinking but many do overlook the details in between that could significantly upend the financial success so many are counting on.

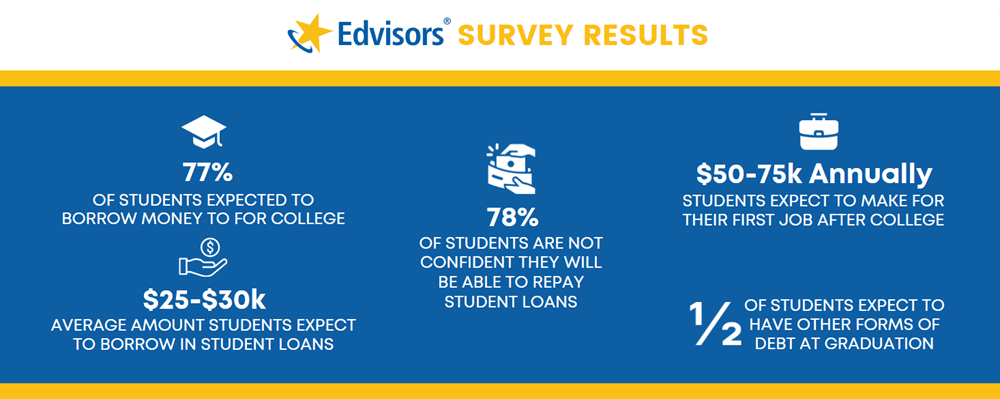

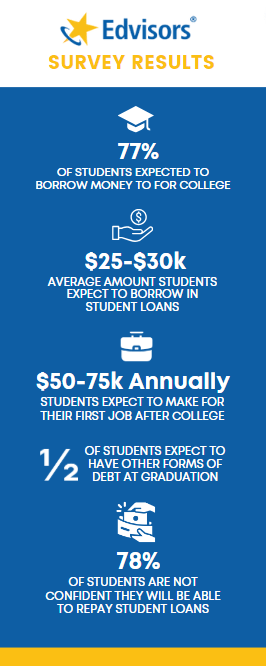

Edvisors recently surveyed 1,000 students and the results revealed a disconnect between the financial requirements to get the coveted college degree and how to actually pay for it after graduation. For the most part, students had realistic expectations when it came to the necessity to borrow money to attend college and expected earnings after college. However, when asked about confidence to repay debts after graduation, including student loans, most where “hoping for the best” all the while knowing they weren’t going to make enough of a salary to be in a position to easily pay for their student debt.

What Students Said:

-

Most students expect to borrow money to pay for college – 77%.

- This is to be expected, tuition costs have skyrocketed over that last five decades increasing more than 8x faster than salaries.

- Most students expect to borrow an average of $25-$30K in student loans.

- This is consistent with statistics for average student loan debt at graduation of around $37K

- Most students expect to make between $50-$75K annually for their first job after college.

- This is a reasonable assumption if not a little optimistic as the average starting salary for newly minted graduates averages in the high $50’s. What’s a bit shocking is that 40% of students surveyed expect to make more than $75K to start, with 10% of that group hoping to make a whopping 6-figures right out of school.

- Half of students expect to have other forms of debt at graduation – credit cards, car loans, etc.

- That only half of students expect to have other forms of debt is a little more optimistic than should be. While many students may have the desire to avoid debt, the likelihood of not having either or both - a credit card with a balance or a car payment by 22-23 years old is not very realistic. Statistics show that over 70% of GenZ have an auto loan (with an average payment of $400 a month) and nearly 30% have credit balances over $1,000.

- Most students – 78% are not confident and/or are hopeful they will be able to repay student loans.

- This “I’ll figure it out later” mentality without a real plan to actually figure it out sets the stage to cause a lot of heartache when these students enter the workforce and face realities they aren’t prepared to deal with.

The Cost of Living with a College Degree

Given 77% of students acknowledge the need to borrow money, it can be assumed student loan debt is as much cost-of-living budgeting item as rent or gas. Every form of media is ripe with stories of students and their parents drowning in student loan debt. President Biden’s recent attempts to forgive up to $20,000 of student debt for qualified federal borrowers speaks to the severity of the issue.

Americans currently owe about $16.9 trillion in total debt (meaning all forms of debt). After mortgage debt (about 11.9 trillion), student loan debt and auto loans (about 1.5 trillion each) tie for the next largest pieces of the debt pie, followed by credit card and other debt. What’s unique about student loan debt as compared to other types of debt, is that there is no way out – in most cases, bankruptcy is not an option for debt relief, making this type of debt very risky to obtain without a plan.

Edvisors recently introduced a quarterly student loan Repayment Relief giveaway to help students pay down their student loan debt. Interested students can simply fill out a quick form and they are entered. Once each quarter a winner is named and given $2,500 to help pay down their student debt.

It’s clear that students understand the necessity of assuming student loan debt on their quest for a college degree but how they might repay that debt is not given the proper consideration. While the average graduate has a starting salary in the mid $50’s, many will make less than that, while only some will make more.

A quick look at the numbers reveals a tight situation for the average graduate.

| Sample Budget for a New Graduate* | $55,000 Annual Salary |

|---|---|

| Take Home Pay/Month | $3,000 |

| Rent, Utilities, Phone | $1,500 |

| Car Payment, Insurance, Gas | $600 |

| Food | $300 |

| Student Loan | $300 |

| Total | $2,700 |

| Money for Other Expenses | $300 |

Not included: savings, credit card payments, clothing, entertaining, gym membership, subscriptions, prescriptions, pets, eating out, charitable donations, retirement, etc.

If you assume 10% for savings and another 10% for all these other expenses – the average student is under water.

*All figures are estimated

Other opportunity costs to be taken into account for college students include: lost income while attending school full-time, lost years of work experience while in school and the potential of a prolonged college experience, should there be a change your major or delay in the decision to determine a major in a timely manner, it would increase the time in school and an in turn the total cost of education.

Benefits of Opting to Get a Degree

To be fair, students would not tolerate rising tuition, the spectrum of debt and lost years of experience and wages if there’s weren’t the promise of a better life on the other side of the degree. Data shows that the average person with a bachelor’s degree will earn over a million dollars more in their lifetime than someone with only a high school diploma.

College degrees also provide for a head start on that higher lifetime salary by affording graduates larger starting salaries. The average college graduate starting salary is about 1/3 higher than that of a high school graduate. Granted the high school graduate starts work sooner but the college graduate will make up those lost earnings and more in less than decade.

Suggestions to Overcome the Risk Reward Disconnect

Just because paying for a degree will be challenging doesn’t mean that it’s impossible. There are strategies that can help reduce costs making the debt load after graduation more bearable.

Gap Year(s)

There’s no hard and fast rule that students must start college right after high school. Taking a year or two break could be ideal, not only for the mental break after 13 years of non-stop education but also to see the world, get to know themselves, learn what they really like and don’t like. This time could be used to narrow in on what to really spend time on and what type of career truly is most suitable.

Nothing could be worse than to pay tens of thousands of dollars to work in field that turns out that isn’t the right fit after all. About 20% of new graduates struggle to find jobs for positions related to their degree and less than half will end up working in within their field of study.

Some time off to distill true passions and desires could be very helpful. This time could also be used to work and save money to help pay for the degree when it is known exactly what it’s going to be. It’s a win-win for those willing to prolong their graduation date.

Community College

Community college is a very affordable option for getting general education credits out of the way, while still living at home and saving money on housing costs. It doesn’t have the same cache as going to straight to university but for anyone hoping for less debt after graduation, this is a viable option that should be considered.

Be sure to confirm that any units taken will transfer (in most cases they will), and by attending a community college as an interim step to a degree it reduces the costs of the degree. A degree, which by the way, will bear the name of the school a student graduates from without any indication that some of the classes required to obtain it came from a community college. This is a little savings secret no has to know about.

In-State Tuition Savings

Private schools not withstanding, where in-state or out-of-state status has no bearing on cost, in-state tuition at a state-run college or university can be significantly less than out-of-state tuition. In some instances out-of-state tuition costs will rival those of private schools making in-state the best way to go. For students already residing in the state where they want to go to school this will be easy to obtain as they will have already established residency.

However, if anyone wanting to get in-state tuition for a school that is not in their current state, this too can be achieved when combined with one of the previously mentioned strategies. Taking a gap year for example, where the student could move to the state they plan to attend college in, work, save up some money and establish residency at the same time.

Or for those that don’t want to lose momentum in their pursuit of a degree, they could move and attend a community college for a year or two to establish residency. This will not only enable in-state tuition but the student can save even more money by getting some credits out of the way at the community college.

Work and Attend College Part-Time

Finally, there is always working part-time or full-time while attending school part-time. With fewer units the tuition will cost less each semester, although it will take longer to graduate and the final cost might not be less than attending full time but the costs come in more digestible amounts that could be paid over time, not requiring any money to be borrowed at all potentially. Yes, it will take longer to graduate, but graduating with no debt at all makes this a strategy that surely should be taken into consideration.