The content and opinions provided on this site have not been provided or commissioned by any issuer of the financial products and/or services appearing on this site. The content and opinions have not been reviewed, approved or otherwise endorsed by an issuer. Offers may be subject to change without notice. For more information, please read our full disclaimer.

What is a Credit Score?

Think of your credit score as a report card for how you handle debt and payments. It gives lenders a snapshot of how risky it might be to lend you money. A strong credit score can make borrowing easier, while a low score might raise some red flags for lenders.

Your credit score is a number that falls within a range, from low (poor), to high (excellent). The lower your score, the more of a credit risk you are. The higher your score, the lower the risk, and the more likely you are to get approved for credit and qualify for better rates.

There are two main types of credit scores you’ll encounter. The FICO® Score and the VantageScore. Though they use slightly different scales and different methodology to calculate their scores, the general principles for earning and maintaining a good credit score are the same for both.

There are three major credit reporting companies that collect information and calculate your credit score: Equifax, Experian, and Transunion. Your credit score may differ slightly between these agencies because each of them, sometimes referred to as "credit bureaus," maintains their own credit report information. It is unlikely that your credit report will match identically across all three companies at any given time.

What is a FICO Score?

FICO stands for Fair Isaac Corporation which is the first company that developed a universal scoring model. The FICO® Score methodology is used by roughly 90% of all lenders in the U.S. today. FICO Scores fall on a range of 300 to 850.

What is a Good FICO Score?

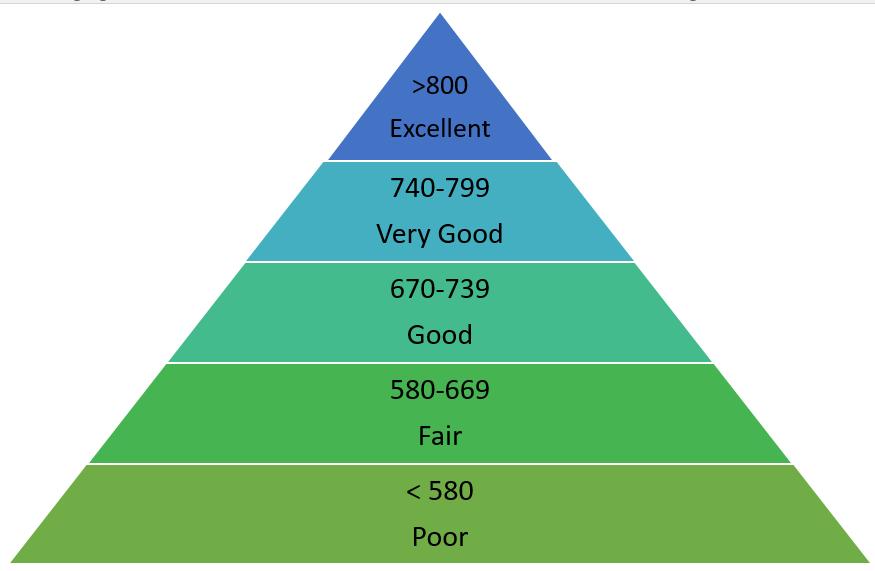

FICO score ranges are set to identify poor credit scores, all the way up to excellent credit scores. The following chart shows the range for each category. If your FICO score is 670 or higher, you are considered to have good credit, with scores 740 or higher falling into the very good range. A FICO score over 800 is considered excellent.

What is a VantageScore?

The VantageScore® (established in 2006) is similar to the FICO® Score. Both rank your credit from low to high on a numeric range. The VantageScore 3.0 goes from 300 to 850.

What really makes the VantageScore different is that it claims to help more consumers who would otherwise be ignored by the FICO model. This includes individuals who are new to credit or who do not need to use credit very often. The VantageScore was originally created by the three major credit reporting companies, Equifax, Experian and TransUnion.

What is a Good VantageScore?

A good VantageScore® is considered to land above 660, and if your score is over 780, that is typically considered excellent credit. Note however, every lender may review a number of other factors when considering whether they will approve you for a loan or line of credit, and your numeric score may be only one part of the equation.

Why Your Credit Score Matters

Credit scores are one of the factors lenders use to determine how much of a risk they are taking when lending to someone. While lenders may also look at other factors such as salary, employment history, and debt to income ratio, your credit score definitely plays a large role. Having a healthy credit score can help you qualify for lower interest rates, and prevent the need for a cosigner.

How is a Credit Score Calculated?

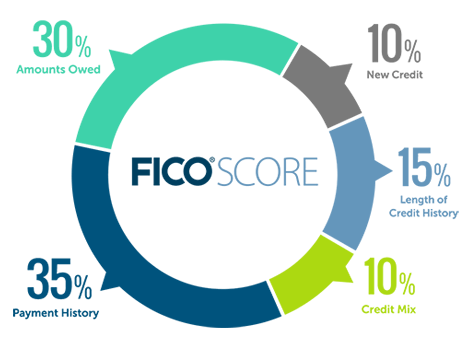

Each one of the credit companies uses their own unique equation for calculating your credit score, but the primary factors that impact your score don’t really change. When it comes to FICO, credit scores are calculated based on five different categories:

- Overall payment history

- Amount of debt you owe

- Length of your credit history

- Your credit mix (i.e., types of credit)

- New credit

As demonstrated in the pie chart below, the FICO® Score assigns a certain percentage to each factor that adds up to your total score. Some factors are weighted more heavily than others, like your “payment history” (which indicates how well you manage to pay on time) and “amounts owed” (which reveals whether or not you’re overextended in total debt compared to your income and ability to pay).

Fair Isaac Corporation (2019, November 19). What’s in my FICO® Scores? Retrieved from https://www.myfico.com/credit-education/whats-in-your-credit-score

Now let’s take a closer look at these categories, payment history, amounts owed and length of credit history, and breakdown what each means.

Payment History

This refers to your payment habits on previous loans, bills, or credit cards. Have you made expected payments on time? Do you pay your utilities on time? (Some companies have started to capture this.) When you don’t make good on your promises to pay, whether it’s the light bill, a medical bill, retail store credit card, major credit card, cell phone, student loans, etc., it will likely get reported to the credit reporting companies.

Negative items can stay on your credit report for up to seven years. Bankruptcies can stay on your report for up to ten years. Ouch!

Amounts Owed and Credit Utilization

The amounts owed is critical because it highlights the levels of debt you have and whether you are potentially overextended. If the total amount of all your loan and credit card balances is high, this could signal that you may have difficulty managing your monthly obligations; lenders may not be inclined to lend to you if that is the case.

You may see references to credit utilization on your credit report or score explanation. The goal with credit utilization is to keep it under 30%. This essentially means, what percentage of your total revolving credit you are using. For example, you have four credit cards that each have a credit line of $5,000. In this scenario, these four credit cards are the only revolving credit lines you have. Your total revolving credit available is $20,000. You have the following balances on each one of our credit cards: Card 1, $3,000; Card 2, $4000; Card 3, $2,000; Card 4, $1,000. Based on the balance of each card, you are using $10,000 of your available $20,000 revolving credit. Your credit utilization would be 50%. Another place you may see a reference to your credit utilization could be if you are logged into one of your credit card accounts. For example, you are logged into your account for Card 1. You may see a note that you have a credit limit for your card of $5,000 and that you have used $3,000 of your credit limit. Your credit card may note that your credit utilization for that specific account is 60%.

Also, if you’ve heard of a debt-to-income ratio, the amounts owed category is part of that evaluation. Creditors look at your income level compared to the outstanding installment debt (cars, home mortgage, etc.) you owe to determine if you are maintaining a healthy balance that allows you to easily manage not only your current payments, but any new loan amounts that may be up for consideration. Sometimes lenders may approve a new line of credit or loan in a lesser amount than you’ve requested, if it means keeping your debt-to-income ratio manageable.

Length of Credit History

The length of credit history is based on the average age of all your accounts. Your oldest loan or line of credit will have a big influence on this. Coming in at 15% of your total score, your credit history length can be a strong contributor to your total score. If you are a young borrower, check out our article on building good credit while in college for tips on how to begin building a solid credit history. There are a few things you can do to help this along, but Google defines history “as a whole series of past events connected with someone or something,” so establishing a lengthy credit history just takes time.

Credit Mix

The different types of accounts you have on your credit profile is known as the credit mix. The combination can consist of installment accounts (such as auto loans, mortgages, student loans) and revolving lines of credit (such as credit cards and retail store cards). The more responsible experience you have with different types of credit, the better. Of course, that takes time to build.

New Credit

While the new credit category only accounts for 10% of your score, it is best not to have too many newly opened accounts back to back (or in a short period of time). One risk you face is bringing down the average age of all your accounts. And as we’ve covered above, length of credit history makes up 15% of your score so length of credit history and new credit work hand-in-hand. If you’re trying to get approved for a new loan, this is something you’ll want to be particularly sensitive to.

Factors that Do Not Affect Credit Score

It is illegal for credit scoring formulas to consider race, religion, color, sex, marital status or national origin. Credit scoring formulas also may not take into consideration your age, where you live, or soft credit inquiries.

Your occupation, salary, employer and employment history are not factors that affect your credit score, however, lenders may factor in this information when making credit approval/denial decisions.

How to Get a Good Credit Score

Paying all debts on-time is the best approach to achieve a good credit score. It's not limited to credit card or student loan payments; it encompasses all debts like rent, mortgage, utilities, medical bills, and car payments. Any failure to make on-time payments can negatively impact your credit report and lower your credit score.

Factors that Affect Your Credit Score

Other factors that can contribute to your credit score include the amount of credit you have available vs. how much credit you use (i.e., are your credit cards maxed out? If so, this can have a negative impact on your credit score, even if you are making all of your payments on time). How many credit accounts you have open and how long they have been open for, any new accounts you may have opened, and the number of hard inquiries you’ve initiated into your credit report.

How to Improve Your Credit Score

Improving your credit score takes patience and time, but there are several actions you can take to start steering your credit score in the right direction.

Pay off any delinquent debts

If you have delinquent debts such as overdue utility bills, unpaid medical bills, missed car payments, etc. on your credit report, pay them off.

Pay current debts on time

Pay all current debts on time. This includes everything from car payments and student loans payments to your cell phone and electric bill. Any delinquent debts may show up as negative items on your credit report.

Pay down high balance credit cards

If you have high balances (meaning your balance is near or at your credit limit), pay them down. It’s best to only use credit cards for items you can actually afford and to pay the balance off each month. Not only will this save you on interest, but it demonstrates responsible credit usage and can have a positive impact on your credit score.

Don't close unused credit cards

Provided you’re not paying annual fees on your credit cards, do not close accounts just because you don’t use them. One factor that goes into calculating your credit score is the amount of credit you have available to you, vs the amount you use (your credit utilization ratio). Keeping these accounts open and in good standing can have a positive impact on your credit score.

Open new accounts only when needed

Only open a new account when you absolutely need to. Do not open several credit cards accounts that you don’t use thinking this will help to improve your credit score. It will not. Opening new accounts also result in hard inquiries to your credit report. Too many hard inquiries can have a negative effect on your score.

Use a secured credit card

A secured credit card is a credit card that is backed by a cash deposit. This is a great way for those with bad or no credit to start establishing credit. The amount you pay upfront may be equal to your limit (for example, a $300 deposit for a card with a $300 limit). Use a secured card responsibly and make your monthly payments to help build or rebuild your credit.

Dispute incorrect items on your report

It’s important to review your credit report at least once a year (if not more frequently). This is your opportunity to make sure all of the accounts attributed to you are yours and that all reporting on how you’ve been handling your debts is accurate. If you notice anything on your credit report that seems incorrect, you may initiate a dispute with the credit reporting company to get the information corrected.

How Often Is My Credit Score Updated?

Credit scores are typically updated every 30-45 days, although the frequency may vary depending on your creditor. While most companies report information to credit bureaus monthly, there are no set standards for when updates must be provided. Each creditor operates on its own timeline for transmitting data. If you're keeping an eye on your credit report for progress or changes, anticipate that it might take more than a month to observe any updates.

For those working on rebuilding their credit, remember that improvement takes time. By following the right steps, you will gradually see positive changes in your credit score.

How Do I Find My Credit Score?

Today, there are a number of options to help you stay on top of your credit score. Many credit cards will feature your credit score on your monthly statement, and most of the major banks with checking and savings accounts offer to provide your score as a value-added service. Even student loan lenders such as Sallie Mae offer a free or low-cost monthly monitoring service so you can take control of your credit. But if you want to dig more in-depth into your credit health, you may need to work with the credit reporting companies directly.

To clarify, by law you are entitled to one free report every 12 months from each of the three credit reporting companies. If you’re interested in achieving and maintaining good credit, you should definitely take advantage of this. But getting a free copy of your credit report does not necessarily mean it will include your actual credit score. You may pay to view your credit score, or you may be offered a view of your credit score through one of your creditors.

There are some credit monitoring tools and services you can subscribe to for a few. These services can keep you alert to any inaccurate or fraudulent activity on your accounts. If you’ve been struggling with a low credit score and you’ve been working hard to raise it, monthly monitoring may help keep you motivated as you see that number get higher and higher!

Another way to get your score is through a new creditor that you’ve submitted an application to (for a loan or credit card). This is especially true if you’ve ever been denied credit. If/when this happens, you are entitled to a copy of your credit report through one of the credit reporting companies so that you can better understand what contributed to the denial.

How to Challenge Items On Your Credit Report

Let’s say you have found something on your credit report that is wrong. This could be a reported past-due payment that you have the receipt for, or a credit card that was opened in your name without your knowledge (as in cases of identity theft). As a consumer, you have the right to challenge these items. The Federal Trade Commission (FTC) can provide you with tips and sample letters on how to dispute an item and correct errors on your credit report.