Taking control of your personal finances is a crucial part of starting adulthood. One important aspect of this is learning about credit and how it affects your life. Your credit shows how trustworthy you are with managing money, which can impact your ability to borrow and repay loans.

Having a strong credit score can give you plenty of benefits. You could get lower interest rates on loans, have a better chance of renting an apartment, and even pay less for insurance. Starting to build your credit early, like when you're 18, is really helpful. It helps you create a solid credit history that shows you're responsible with money, paving the way for a stable financial future and more opportunities.

The CARD Act of 2009 (Credit Card Accountability Responsibility and Disclosure Act) safeguards consumers from deceptive practices in the credit card sector. It enforces rules restricting credit card issuance to minors and students under 21 unless they have independent income or a co-signer.

Understanding Credit

In its simplest form, credit is a tool that allows you to borrow money with the promise to repay it in the future. The measure of your ability to fulfil this promise is represented by a credit score typically calculated by one of the two primary models FICO® and VantageScore®. Your credit score, usually a number between 300-850, is calculated based on certain components of your financial activity.

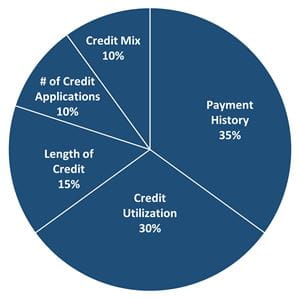

The most significant factor in your credit score is your payment history, which accounts for 35% of the total score. This involves your track record of paying off debts, with timely payments boosting your score, and late payments detrimentally impacting it. The amount you owe, or credit utilization, accounts for 30%. It's crucial to maintain a balance and not max out your credit cards, as this can negatively affect your score.

The most significant factor in your credit score is your payment history, which accounts for 35% of the total score. This involves your track record of paying off debts, with timely payments boosting your score, and late payments detrimentally impacting it. The amount you owe, or credit utilization, accounts for 30%. It's crucial to maintain a balance and not max out your credit cards, as this can negatively affect your score.

The length of your credit history makes up 15%. This is where starting early provides an advantage, as a longer history usually equates to a better score, assuming you've managed it responsibly. New credit applications contribute to 10% of your score; too many new or unsuccessful applications can lower your score. Finally, the types of credit you've handled contribute to the remaining 10%. A mix of credit card debts, student loans, car loan, etc., can show that you're capable of managing different types of credit.

A good credit score can open up a wide range of financial opportunities. It can lead to easier approval for credit cards and loans, lower interest rates, better car insurance rates, and a smoother process in getting approved for housing. On the flip side, a bad credit score can limit these opportunities, making it harder to secure financial aid when needed. Hence, understanding credit and how to manage it effectively is fundamental to securing a healthier financial future.

The Basics of Building Credit

To best understand your individual credit situation, you need to look at your credit report. A credit report is a detailed summary of your credit history, compiled and maintained by credit reporting agencies like Experian®, Equifax®, and TransUnion®. It contains information about your current and past credit activity including loan paying history and the status of your credit accounts. Regularly monitoring your credit report is a fundamental step in maintaining a healthy credit score.

Just as you would review your bank statements, you should also review your credit report to check for accuracy and detect any signs of fraudulent activity. Nowadays, many services offer free credit monitoring that alerts you to changes in your credit report, making it easier to stay on top of your credit health.

Timely payment of your bills plays a significant role in building a good credit score. Delayed or missed payments can have a detrimental impact and can stay on your credit report for several years. The importance of making payments on time cannot be overstated; setting up automatic payments or reminders can be beneficial in managing this.

Maintaining low balances on your credit cards is another crucial aspect of credit management. This is linked to your credit utilization ratio – the percentage of your total available credit that you're using. A lower ratio is better for your credit score, so it's advisable to keep your balances low in relation to your overall credit limit.

Credit diversity, or having different types of credit, also contributes to a good credit score. This includes revolving credit, like credit cards, and installment loans, such as mortgages or auto loans. Having a mix of these in your credit history shows lenders that you're capable of managing different types of credit responsibly. However, this doesn't mean you should apply for different types of credit all at once. It's important to apply for and open new credit accounts only as needed.

Credit Building Options Available to Young Adults

As an 18-year-old wanting to establish and build credit, a variety of options are available to you. One such option is a secured credit card. Unlike regular credit cards, secured cards require a refundable security deposit, which determines your credit limit. Your activity is reported to credit bureaus just like a regular card, helping you build a credit history as long as you make payments on time.

Another avenue worth exploring is a credit-builder loan. These loans are typically offered by smaller financial institutions like credit unions and are designed specifically to help individuals build credit. The money you borrow is held by the lender in an account and not released to you until the loan is paid off. It's essentially a forced savings program, but your payments are reported to credit bureaus, thereby building your credit history.

Becoming an authorized user on someone else's credit card, such as a parent or a guardian, can also help build credit. As an authorized user, you'll have your own card linked to the cardholder's account, and the account's payment history may be reported on your credit report. This can be beneficial if the account holder maintains good credit habits, but remember, any negative marks like late payments can also affect your credit.

Credit cards geared towards students can be an excellent option for those enrolled in a college or university. These cards, while still subject to the CARD Act mentioned above, will often have lower eligibility requirements for students and can offer benefits like cash back on purchases, no annual fees, and even rewards for good grades. Just like any other credit card, responsible use is key—always aim to pay the balance in full each month to avoid interest and build a positive credit history.

Strategies for Building Good Credit

Building good credit is a journey that requires strategic planning and disciplined financial behavior. Here are some key strategies to consider:

- Pay Your Bills On Time: This is the cornerstone of good credit. Timely payment of all your bills, not just credit card debts but also rent, utilities, and even cell phone bills can have a significant impact on your credit score. Late or missed payments can harm your credit, so consider setting up automatic payments or reminders to ensure you never miss a due date.

- Keep Credit Card Balances Low: Another essential strategy involves maintaining low balances on your credit cards. This goes back to the concept of credit utilization, which is a ratio comparing the amount of credit used to your total available credit. A lower ratio, ideally below 30%, is beneficial for your credit score.

- Apply for Credit Only When Necessary: While having different types of credit can enhance your credit score, it's vital to avoid unnecessary credit applications. Each application results in a hard inquiry, which can negatively impact your credit score. Therefore, apply for new credit accounts only as needed.

- Build a Mix of Credit: Lastly, try to build a diverse credit portfolio that includes both revolving credit such as credit cards and installment credit like student or auto loans. This demonstrates to lenders your ability to manage multiple types of credit responsibly. However, it's essential to ensure that you can comfortably manage and repay all your credit commitments.

These strategies are not quick fixes but rather long-term habits to adopt. Building good credit takes time, but the financial freedom and opportunities it brings make it worth the effort.

Mistakes to Avoid When Building Credit

When embarking on your credit-building journey, it's crucial to be aware of common pitfalls that can hinder your progress.

- Maxing out your credit cards. Keeping your credit utilization ratio - the percentage of your total available credit that you're using - low is crucial for maintaining a healthy credit score. Continually maxing out your cards can negatively impact this ratio and flag you as a high-risk borrower.

- Late or missed payments can also cause a significant dent in your credit score. Your payment history contributes a substantial percentage to your credit score calculation, so it's important to ensure all bills are paid on time. Consider setting up automatic payments or reminders to avoid overlooking a bill payment.

- Beware of the danger of taking on debt without a repayment plan. The allure of credit can lead to accumulating debt faster than you can repay it. Before taking on any debt, it's critical to have a clear repayment strategy. Without one, you can find yourself in a vicious cycle of debt that can severely affect your credit score and financial health.

- Co-signing loans is another potential pitfall. While it may seem like a helpful gesture, co-signing a loan means you're equally responsible for repayment. If the main borrower cannot, or chooses not to repay, you're on the hook for the debt. This can lead to unwanted debt and negatively impact your credit if payments are missed.

It's important to approach credit building with a strategic mindset, avoiding these common mistakes to help secure your financial future. Remember, building a strong credit profile isn't an overnight process - it requires consistent and responsible credit habits.