Compound interest, often called "interest on interest," occurs when the interest you earn on your original investment begins to earn additional interest over time. This important financial principle works like a snowball gaining size and speed as it rolls downhill, steadily building both value and momentum.

Understanding compound interest is key to financial success because it's the principle that can make your money grow exponentially over time. Whether you're saving for retirement, your child’s education, or a personal project, recognizing how compound interest works can help you make smarter investment decisions. Simply put, the sooner you start saving and investing, the more your money can work for you, thanks to the power of compound interest.

How Compound Interest Works

To put it simply, compound interest is what happens when your interest starts earning interest. This concept is distinct from simple interest, where you only earn interest on the principal, or the original amount of money you put in. For example, if you invest $1,000 at a 5% annual simple interest rate, you would earn $50 in interest each year. After 5 years, you would have earned a total of $250 in interest, making your investment worth $1,250.

Now, with compound interest, it's a different and more rewarding story. If that same $1,000 is invested at a 5% annual compound interest rate, the first year's interest calculation would be the same, giving you $50 and bringing the total to $1,050.

However, in the second year, you earn interest on $1,050, not just the original $1,000. This means you'll earn $52.50 in interest in the second year, bringing your total to $1,102.50. This process continues year after year, and after 5 years, your investment will have grown to approximately $1,276.28, instead of the $1,250 you would have earned with simple interest.

This might not seem like a huge difference over a short period, but over decades, that difference becomes massive, thanks to the snowball effect of earning "interest on interest." That's why compound interest is often referred to as the eighth wonder of the world and why it's usually preferred for long-term investments. It brilliantly illustrates how time and the reinvestment of earnings can significantly increase your wealth, making it a paramount concept in personal finance and investment strategies.

The Power of Compound Interest

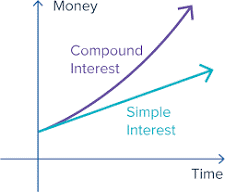

Let’s visualize this on a graph. The straight, linear line represents simple interest growth—it's steady and predictable. The second line depicts compound interest and looks quite different; it starts slowly but then curves sharply upwards, showing much faster growth over time. This curve visually demonstrates the "snowball effect" of compound interest, where your initial investment grows exponentially rather than linearly.

Example 1: Retirement Savings

Suppose at the age of 25, you decide to start saving for retirement. You invest $5,000 annually in a retirement account with an average annual return of 7% (compounded annually). If you continue this until you're 65, you'll have invested a total of $200,000. Due to the power of compound interest, however, your retirement account would grow to approximately $1,0763,048.

Now, consider if you had started doing this at age 35, ten years later. You would invest $150,000 over 30 years, and your account would grow to about $566,416 by age 65—a sizeable sum, but nearly half of what you would have if you started ten years earlier.

Example 2: College Savings

You open a college savings account for your child when they are born, depositing $3,000 and then adding just $100 a month until they turn 18. Assuming an average annual return of 6% (compounded monthly), by the time your child is ready for college, you will have deposited $24,600. However, thanks to compound interest, the account's value would be approximately $46,204. This is nearly double the money you put in, turning a relatively modest monthly saving into a significant college fund.

Example 3: Reinvesting Dividends

Consider you purchase $10,000 worth of stock in a company that pays a consistent annual dividend yield of 4%, and instead of taking those dividends as cash, you reinvest them in buying more shares. Even if the stock price doesn't increase, after 25 years of reinvesting dividends and benefiting from compound interest, your initial investment could grow to over $26,658.

These examples underscore how integrating the concept of compound interest into your financial strategy can significantly boost your savings and investment returns over the long term. Starting sooner rather than later can profoundly impact your wealth accumulation due to the exponential growth compound interest provides. Remember, compound interest favors the patient, and as these examples illustrate, even modest investments can grow into substantial sums over time.

Why Young Adults Should Care About Compound Interest

Understanding compound interest and its long-term effects isn't just useful; it's a game-changer, especially for young adults. Think of compound interest as a tidy garden that grows more bountiful and lush the longer you tend to it. Now, why should you, as a young adult, care? Because time is on your side, and in the financial world, time equals money.

This concept ties back to the time value of money, which simply means money available now is worth more than the same amount in the future due to its potential earning capacity. The idea of "the earlier, the better" plays a pivotal role here—starting your savings or investment journey early allows your money more time to grow through the magic of compound interest.

Consider two friends, Jamie and Taylor. Jamie begins investing $2,000 yearly at age 20 in a retirement account with an annual return of 6% and stops at age 30, investing a total of $20,000. Taylor, on the other hand, waits until they're 30 to start investing $2,000 annually until age 40, also contributing $20,000.

By the time they both turn 60, Jamie's investment, thanks to starting a decade earlier and allowing compound interest to work its marvel for a longer period, grows to approximately $183,967. Taylor's investment grows to about $122,708. Despite investing the same amount, Jamie ends up with a significantly larger sum by capitalizing on the time value of money and starting earlier.

This story illustrates not just the power of compound interest but also highlights the crucial concept of "the earlier, the better." By beginning your investment journey as early as possible, you give your money the greatest gift—more time to grow. This understanding empowers young adults to take control of their financial futures today, rather than tomorrow, ensuring a lush, fruitful garden of wealth in the years to come.

How to Take Advantage of Compound Interest

Taking advantage of compound interest, often hailed as one of the cornerstones of growing wealth, can seem daunting at first. However, it's quite manageable once you understand the basics and start taking small, consistent steps. The key to harnessing the power of compound interest lies in starting early, making regular contributions, and ensuring the interest earned is reinvested rather than spent. This trifecta of actions ensures your money doesn't just sit idly but grows exponentially over time.

How to Start Investing Early:

- Start Now: Don’t wait for a "perfect" time to start because, in the realm of investing, earlier always beats perfect. Even small amounts can snowball into significant sums over time, thanks to compound interest.

- Regular Contributions: Make it a habit. Set up automatic contributions, no matter how small, to your investment or savings account. Consistency is key, and even modest, regular investments can lead to substantial growth over time.

- Reinvest Dividends and Interest: Instead of taking out any interest or dividends, reinvest them. This is how you truly capitalize on the magic of compounding - your investment not only grows from your contributions but also from the reinvested earnings.

Where to Invest or Save for Compound Interest:

- Savings Accounts: Look for high-yield savings accounts. They might not offer the highest return, but they’re a safe place to start and get accustomed to seeing compound interest at work.

- Retirement Funds (401(k)s and IRAs): Retirement accounts are perfect for long-term investments and usually benefit from compounding. Many employers offer 401(k) matches, which can further boost your savings.

- Stock Market: Investing in stocks or mutual funds can offer higher returns, albeit with higher risk. Dividend reinvestment plans (DRIPs) are a great way to automatically reinvest dividends and benefit from compounding.

- Bonds: While offering lower returns compared to stocks, bonds can be a more stable investment and still take advantage of compound interest.

- Education Savings Accounts: Accounts like 529 plans offer the opportunity to save for education while benefiting from compound interest.

The essence of growing your wealth through compound interest lies not in making sporadic, large contributions but in the consistency of your efforts and allowing your investments the time they need to mature. Every day you delay is a missed opportunity for your money to grow. Approach your financial future as a long-term project—start small if you must, keep at it regularly, and always choose to reinvest your earnings. The road to financial independence might seem long, but with compound interest as your ally, every step is significantly more fruitful.