The content and opinions provided on this site have not been provided or commissioned by any issuer of the financial products and/or services appearing on this site. The content and opinions have not been reviewed, approved or otherwise endorsed by an issuer. Offers may be subject to change without notice. For more information, please read our full disclaimer.

Managing your money is a skill, especially when you’re working with a tight budget. It’s a challenge many young adults and college students face. You should know however, even if your budget is limited, you can still save. You don’t need to start big. Small, steady deposits add up over time. Plus, with the power of compound interest, those small steps can grow into something much bigger. The sooner you start, the more time your money has to grow, laying the foundation for a strong financial future.

If you’re opening your first savings account or thinking about switching to one that suits you better, there are a few key features to consider. Look for a higher interest rate to help your savings grow faster. Even a small difference in rates can make a big impact over time. Watch out for hidden fees that can chip away at your savings. Accounts with little to no fees work best to help you keep more of your money. Make sure your account is convenient too. Options like online banking, mobile apps, and easy ATM access allow you to manage your money from anywhere.

Many banks offer savings accounts tailored for students or young adults. These often come with perks such as no minimum balance requirements or reduced fees, making it easier to start saving without added worries. Take time to compare different options and choose the account that fits your needs.

Consistency is key when it comes to saving. Starting small is okay. Setting aside a little money regularly helps build both your savings and strong money habits. Over time, these habits can help you reach goals like creating an emergency fund, saving for big purchases, or even preparing for future investments.

Saving might be hard to start at first, especially when your income is limited and expenses are high. But by picking the right account and staying committed, you’ll find money management becomes easier. More importantly, you’ll feel confident knowing you’re paving the way for success. Every small step you take brings you closer to taking charge of your finances and building the future you want.

What is a Savings Account?

A savings account is something you set up at a bank or another financial institution to keep your money safe. It's not just about storing your cash; it's also about having it handy for things you might need soon. These accounts usually give you more interest than checking accounts do, which means your money can grow while it sits there. It's important to note, some savings accounts might ask you to keep your money there for a certain time, and taking it out early could mean you have to pay a fee.

Also, the rules of your savings account might limit how often you can take money out each month. So, it's really important to get the lowdown on all the details from the bank before you decide to open an account.

Benefits of a Savings Account

One of the best things about a savings account is knowing your money is safe and insured with the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per person, per insured bank, for each account type protecting your savings against theft or bank failure. Savings accounts also help you save money. They help you separate the money you need for your daily expenses from the money you are trying to save. It’s also beneficial because the money in your savings account can earn interest.

If you have a checking account along with your savings account, you can connect the two accounts to easily transfer funds between them. This can also help to avoid overdraft fees with automated overdraft protection (if your institution offers this service) should you take out more money than you currently have in your checking account. Your bank or credit union may have a fee associated with overdraft protection.

Uses of a Savings Account

While it may seem easy to keep all your money in one account, putting some of your money in a separate savings account can be a good way to ensure you save your money as well as earn some interest. This can be important if you are trying to save for a vacation or a large purchase.

>>> Read More about Financial Goals

Depending on your bank or credit union, you may be able to automatically deposit a part of your paycheck directly into your savings account, or you may have the option to create regular automatic transfers that move money from your checking account to your savings account. This is a good way to pay yourself first (by automatically moving money into your savings) before you get tempted to spend it elsewhere.

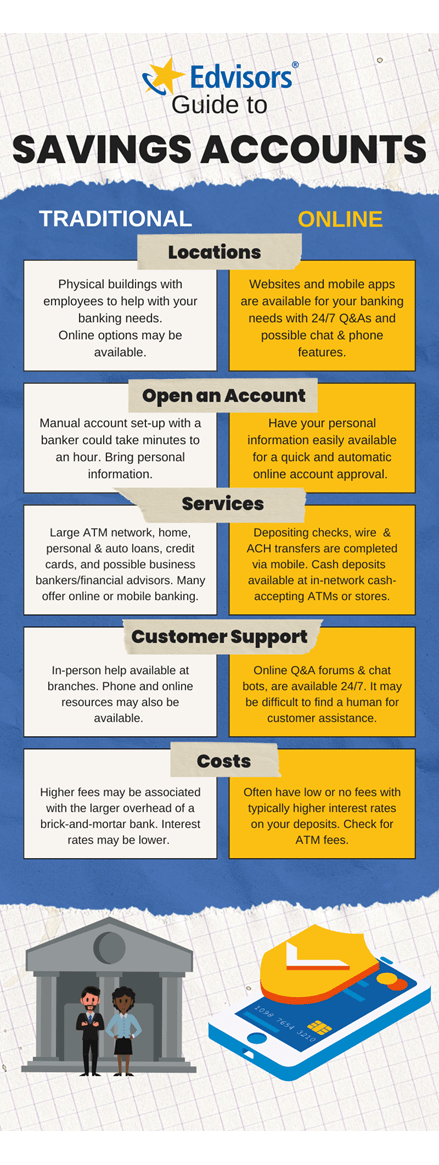

Traditional Savings Accounts vs Online Savings Account

.

.

High-Yield vs. Traditional Savings Accounts

A high-yield savings account tends to offer a much higher interest rate or APY (annual percentage yield) than a traditional savings account. You can usually find these accounts offered online from a variety of different banks. It’s possible to have a high-yield online savings account from a different financial institution than the one that holds your checking account. However, it might be worth having your money in different places due to the attractive interest rates which can pay up to 15-20 times the national average. A high-yield savings account can easily link to your checking account, even if it is with a different bank, for easy money transfers.

While financial institutions may offer lucrative APYs to entice you to open a savings account, realize your APY will not always stay the same. The APY that you open your account with is not guaranteed, as the Federal Reserve can change the federal funds rate at any time. When the Fed adjusts the rate, financial institutions tend to modify their rates as well. It is in your best interest to research the account to ensure they have historically offered high APYs to help you access the greatest rate of return on your savings.

Choosing an Online Savings Account

When it comes to choosing an online savings account, you should take the following items into consideration to help you make the best decision in regards to your money:

- Annual percentage yield (APY) is important as that will be how much you get paid for keeping your money at that particular financial institution. Remember that the APY can change weekly or monthly, depending on the rate insured by the Federal Reserve.

- Fees are also important to take into consideration. Does the institution require a minimum deposit to open your account? Do you need to contribute a certain amount to your account each month to waive maintenance fees? Is there a minimum account balance required in order to earn interest? Talk with a banker to learn more about the fees you may have to pay.

- Federal Deposit Insurance Corporation (FDIC) insured means that your account is protected up to $250,000 per depositor per bank for each account ownership category. If you are looking into a credit union, it should be insured by the National Credit Union Administration (NCUA).

- Online and mobile apps with solid, dependable features for checking your accounts, depositing checks, transferring money between accounts, bill pay, and ability to transfer money to friends (such as Zelle) can make your banking experience much more seamless.

- Many brick and mortar banks offer options for online banking. If you prefer being able to walk in and talk with a banker, make cash withdrawals or deposits, check to see if there is a branch located close to your campus or where you live.

- Withdrawal options have been restricted in the past by the Federal Reserve Board, but today your institution may have its own withdrawal policy on how many withdrawals from your savings account you can make each month. Before you open an account, know and understand the withdrawal policy of for your account.

- Student savings accounts are also available from many banks and credit unions to help you begin your financial journey while helping you to practice responsible spending and saving. Typically, students are encouraged to open both a checking and savings account. This allows students to put their larger amounts of money (such as the money they get from their student loan providers) into their savings where it can earn interest until the time when they need it. Then when tuition and fees, rent, or other big payments come due, you can transfer the funds from your savings account to your checking account.

Best Savings Accounts

| Financial Institution | Physical Branch, Online, or Both | Linkable Checking Account | Fees |

|---|---|---|---|

| UFB High Rate Savings | Online | No checking account available, but free transfers between direct deposit accounts is available | No monthly maintenance fee |

| CiT's Savings Connect Account | Online | eChecking available | No monthly maintenance fee, required $100 opening minimum |

| LendingClub High-Yield Savings | Online, branches in Lehi, UT and Boston, MA | Rewards Checking available | No monthly maintenance fee, no minimum balance after initial $100 transfer |

| First Foundation Bank Online Savings | Online with 31 physical brancehs in California, Florida, Nevada, Hawaii, and Texas | Personal checking available | No monthly maintenance fee, no minimum balance required |

| SoFi Checking and Savings | Online | Checking account available | No monthly account or service fees |

| Sallie Mae High-Yield Savings Account | Online | No | No monthly maintenance fee, no minimum balance fee |

| Ally Online Savings Account | Online | Available checking account | No monthly maintenance fees or minimum balance requirements |

| Marcus by Goldman Sachs Online Savings Account | Online | No | No monthly fees |

| Synchrony Bank High Tield Savings | Online with branches in Georgia, Kansas, New Jersey, North Carolina, and Utah | No | No monthly maintenance fees |

| Discover Bank | Online | Launching soon! | No monthly maintenance fees or minimum balance |

| Chime | Online, but can deposit cash into your accounts at your local Walgreens location for free when you have a checking account | Available checking account | No monthly service fee or minimum balance |

How to Open a Savings Account?

When it comes to opening a savings account, it’s a fairly standard process. After doing your research and choosing the correct bank that meets your needs, gather your needed information to open the account:

- A driver’s license or passport (or other government-issued ID)

- Your Social Security Number or Individual Taxpayer Identification Number (ITIN) if you don’t have a Social Security Number

- Your date of birth

- Proof of address (lease or mortgage documents, utility bill, bank statement)

- Contact information (phone number, email, etc.)

- Bank account information (account and routing number) to make an opening deposit if the bank requires it

While not all banks require this information for opening an online savings account, having the above information ready will help you more easily move through the online application process. Read through the application before you get started to ensure you have your needed information handy.

Once your application is submitted, your bank will confirm your information and notify you if your application has been approved or denied. You may know instantly if you have been approved, but it could also take up to a couple of days, depending on the bank. Most banks do have the option to apply online, but there may be the occasional bank that requires you to apply in-person at a physical branch.

Read More: The Difference Between Savings and Checking Accounts

Savings Account Terms to Know

Opening deposit – the initial amount of money you need in order to open up a savings account. Some banks require a certain amount, while others will open an account for you for $0.

Direct deposit – instead of being paid with cash or a physical check, your funds are directly deposited into your checking or savings account. Talk with your employer to find out if direct deposit is available to you.

Monthly deposit – some banks require you to put a certain amount of money in your account each month to keep your account free.

Monthly balance – not to be confused with a monthly deposit, some accounts may require that a specific amount of money be kept in your savings account (also known as your account balance) to avoid fees.

Interest – the money your financial institution pays you for keeping your money with them.

Compound interest – this is the interest your initial money earns, as well as your initial deposits plus any interest that is accumulated over the compounding period (usually daily or monthly). Each time you earn interest, your new larger balance will earn more interest.

Mobile banking – your bank may provide this service via a mobile app, which will allow you to make financial transactions such as moving money from one account to another, paying another person, depositing a check, or just checking on your accounts by using a smart phone or tablet and the financial institution’s app or website.

Annual percentage yield – also known as the APY, this is the amount of compound interest your account earns over the course of a year. A savings account with a higher APY will increase faster than an account with a lower APY.