The asset protection allowance (APA) shelters a portion of the assets of parents of dependent students on the FAFSA (Free Application for Federal Student Aid), based on the age of the older parent. A similar asset protection allowance applies to independent students. The asset protection allowance has been decreasing at a fast rate since it peaked in 2009-2010, and may disappear entirely by 2018-2019. The decrease in the asset protection allowance makes college less affordable for middle-income students and some high income students, because it reduces their eligibility for need-based financial aid by thousands of dollars.

Recent Decreases in the Asset Protection Allowance

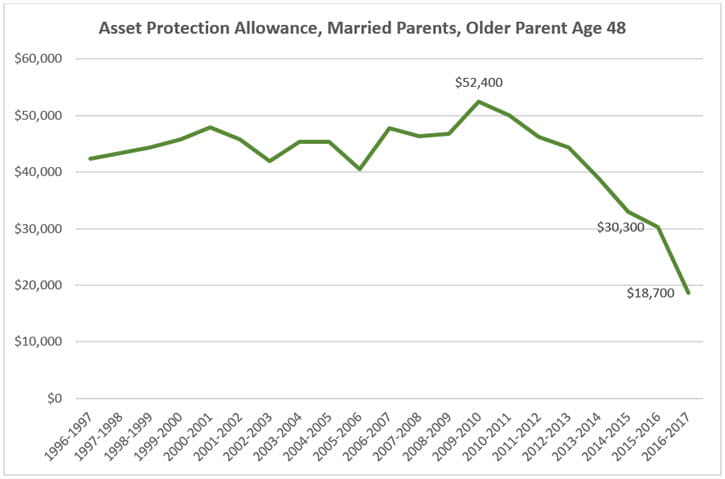

The asset protection allowance for married parent assets, where the older parent in the student's household is 48 years old (the median age of parents of college-age children), has decreased from $52,400 in 2009-2010 to $30,300 in 2015-2016 and to $18,700 in 2016-2017, as illustrated in the chart below.

The asset protection allowance for single parents is even lower. For example, the asset protection allowance for a 48-year-old single parent was only $8,100 in 2015-2016.

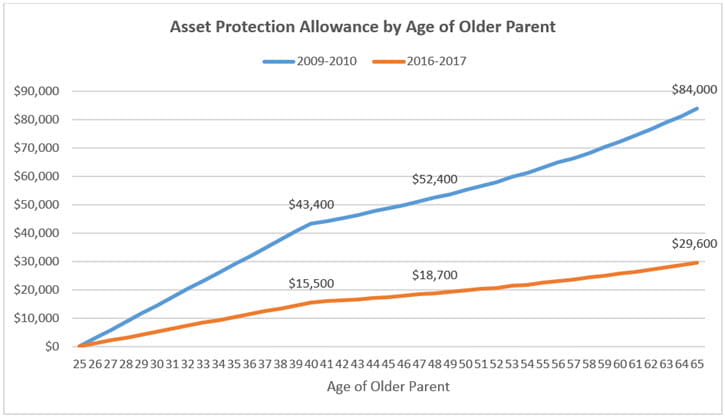

This chart shows how the asset protection allowance varies by the age of the older parent in the student's household and demonstrates the decrease in asset protection allowances from 2009-2010 to 2016-2017.

Impact of the Decreases in the Asset Protection Allowance

Every $10,000 decrease in the asset protection allowance may cut a student's financial aid eligibility by as much as $564. So, the $33,700 decrease in the asset protection allowance for a 48-year-old parent from 2009-2010 to 2016-2017 may decrease a student's eligibility for need-based financial aid by as much as $1,900. For a dependent student whose parent is 65 years old, the $54,400 decrease in the asset protection allowance from 2009-2010 to 2016-2017 may reduce aid eligibility by as much as $3,068.

The decrease in aid eligibility for independent students without dependents other than a spouse is similar. The decrease in aid eligibility for independent students with dependents other than a spouse is not as severe, up to $329 per $10,000 decrease in the asset protection allowance.

The asset protection allowance is now so low that it does not protect basic assets from being assessed by the federal financial aid formula. For example, personal finance experts recommend that people save at least 6 months' salary in an emergency fund to cover unforeseen expenses and job loss. The asset protection allowance now covers only a portion of the money in the typical parents' emergency fund.

The asset protection allowance also does not protect money that parents have saved to pay for their children's college education. The average amount of money in a 529 college savings plan was $20,474 as of December 31, 2014, according to the College Savings Plan Network, an amount greater than the asset protection allowance for most parents of college-age children.

Low-income students may not be affected by the decrease in the asset protection allowance because of the Simplified Needs Test. The Simplified Needs Test disregards all assets on the applicant's FAFSA if the parents (or the student and spouse, in the case of an independent student) have an adjusted gross income (AGI) less than $50,000 and either were eligible to file IRS Form 1040A or IRS Form 1040EZ or someone in the household qualified for certain federal means-tested benefits during the last two calendar years (e.g., Supplemental Security Income (SSI), Supplemental Nutrition Assistance Program (SNAP), Temporary Assistance for Needy Families(TANF), Special Supplemental Nutrition Program for Women Infants and Children (WIC) or the Free and Reduced Price School Lunch Program). So, the decrease in the asset protection allowance mainly affects middle-income and high-income students who don't qualify for the Simplified Needs Test.

Cause of the Decreases in the Asset Protection Allowance

The asset protection allowance tables are revised annually according to rules specified by the Higher Education Act of 1965 in 20 USC 1087rr(d). The asset protection allowance depends to a great extent on the difference between the current moderate family income and the current average Social Security retirement benefits, which can change significantly from one year to the next. When average Social Security retirement benefits increase faster than the increase in a moderate family income, the gap is smaller, leading to a smaller asset protection allowance. The moderate family income has been flat or decreasing since 2009-2010, while the average Social Security retirement benefit has continued to increase, causing a sharp decline in the asset protection allowance.

If current trends continue, the asset protection allowance will disappear entirely in just a few more years.

Since the asset protection allowance depends on current income and retirement benefit figures, it can vary significantly from one year to the next. Even college financial aid professionals often find this lack of stability in the asset protection allowance to be confusing.

In addition, the asset protection allowance is based on a net present value calculation that involves unrealistic assumptions, such as a 6% annual inflation rate, an 8% rate of return on an annuity and a 6% sales commission on an annuity. The annual inflation rate was last at or above 6% in 1982. The average inflation rate was 2.4% over the last 25 years and 3.8% over the last 40 years. The rate of return on an annuity is closer to 2% to 3%.

Recommendations

Congress needs to address the problems associated with the asset protection allowance, perhaps as part of the upcoming reauthorization of the Higher Education Act of 1965.

One solution would involve disregarding assets entirely, adjusting other parameters of the federal financial aid formulas to compensate. A proposal to do this passed the U.S. House of Representatives in 2009, but was dropped in the U.S. Senate in what ultimately became the Health Care and Education Reconciliation Act of 2010.

Another approach would replace the current asset protection allowance tables with the tables from 2009-2010 and increase them annually for inflation instead of basing them on the present cost of an annuity. This would yield a more stable and predictable set of asset protection allowances. It would also be sufficient to shelter the emergency fund of most families, based on median family income.

Congress should also consider sheltering qualified education benefits, such as 529 college savings plans, prepaid tuition plans and Coverdell education savings accounts, from the federal financial aid formulas. This would eliminate any actual or perceived penalty for saving for college, thereby, encouraging more families to save.

The current financial aid formulas also do not offset assets by the amount of outstanding education debt, even though student loans reduce the borrower's net worth. The federal need analysis methodology considers only debts that are secured by a reportable asset as reducing the value of the asset. This penalizes families who borrow to pay for college instead of spending their savings or other assets.