Choosing the right college can seem like a daunting task with so many options and details to think about. To make the process smoother and less overwhelming, we’ve put together a list of key questions and useful tips to guide your decision.

Start by pinpointing schools that seem like a great match for you. Focus on those offering majors that align with your interests. Once you've identified these schools, it's important to dive into the details. Find out the annual tuition for each. While it might seem like you can handle costs later, you definitely want to avoid realizing post-application that affording all four or more years is unfeasible.

The Edvisors® School Snapshot Tool will greatly speed up the process for you, by providing vital information for each of the colleges you are considering.

How to Make a College List

First things first, when deciding on a college there are several questions you have to ask yourself to start creating a list of possibilities.

Choosing a College Major or Program

Ask yourself: “What do I want to study in college? What am I passionate about? What type of career do I see myself in?”

This can be an important question. Do you already have your sights set on a specific profession, like teaching, nursing, aerospace engineering, or HVAC repair?

If you know you want to pursue a specific career path, it’s best that you do some research to see what type of education you’ll need. For example, becoming a teacher or engineer could require a bachelor’s or master’s degree, whereas nursing programs vary with two and four year options, and HVAC repair may require specialized vocational training and certification.

If you’re undecided, it can be a bit more difficult to determine what you need. But if you’ve identified general areas of interest, look for a college or university that offers programs in one or more of those areas.

College Location

Ask yourself “Where do I want to go to college?”

This question is about where you physically want to be. Do you want to stay close to home, or move far away? Are you looking for a big city, or a small college town? What about the campus? Would you prefer an open campus with buildings scattered throughout the city, or a closed college campus where the buildings and dorms are all in the same location.

It’s not uncommon to search for colleges that are both close by and farther away. But really think about this. If you go to college far away, will you have the means to travel home for breaks and holidays? Do you need flexibility due to added responsibilities at home? If so, you may want to consider colleges with online or hybrid programs (a program which has both online and classroom components).

Types of Colleges

“What type of college do I want to attend?” “What type of college can I afford?”

Choosing their college experience is important to many students. Regardless of the type of college you will be attending, each school will offer up its own unique experience. If you aren’t sure what you want to study, then it may be easier to start your search with what type of institution you want to attend.

Note: If you’re unsure of your path, but are starting college anyway, make sure the school you are attending is accredited by a U.S. Department of Education recognized accrediting body, and that your credits will be transferable to most other schools should you choose to change colleges in the future.

- Technical Schools: A technical school will teach you the hands-on skills you need to work in a specific field. Most offer a certificate, diploma credentials as well as the training you’ll need to pass certification tests (typically offered by the professional regulatory body for that career). Usually the programs at a technical school will be two years or less. Some potential careers you can pursue with a technical school education are, hair stylist, massage therapist, physical therapy assistant, electrician, auto mechanic, HVAC repair, etc.

- Community College: Community colleges are usually public, state operated schools. Some offer technical training programs, but they also offer associate degree programs. Most community college programs can be completed in two years or less (depending on your chosen major and course load). Careers you can pursue with an associate’s degree include dental hygiene, office administration, CAD designer, lab technician and more. It’s also not uncommon to use community college to earn an associate degree and then transfer to a four- year college to finish a bachelor’s degree. Community colleges are generally known for being affordable, and many have programs with in-state schools to ensure your credits are transferable (an important thing to research if you think you may transfer).

- Four-Year Colleges: There are several different types of four-year colleges, like public, private nonprofit, and for-profit schools. No matter which you choose, the end result is likely a bachelor’s degree after successfully completing your four-year program. You can earn a bachelor’s degree in a variety of fields, including, arts, business, sciences, political science, etc. There are many careers (and employers) which will require at least a bachelor’s degree for employment, like teachers or accountants.

Cost of College

“How am I going to pay for college?”

All right, this is an incredibly important part of the college selection process. How are you going to pay for college, and realistically what can you (and your family if they are helping) afford?

Incoming students, if you haven’t had this talk with your family or with yourself, it’s time to do it. It may seem like you can just deal with this later, but that’s a risky way to handle your future.

When comparing colleges, here are some key things to identify. Knowing the answers to these questions before you commit can be critical to your college success.

- How much money can I afford to pay out of pocket? Do you have a formal college savings account (such as a 529 college savings plan), or have you been saving for college with a traditional savings account? It’s time to clearly identify how much you have, and how much you can pay per year out of pocket.

- Will you be working to help support yourself? Do you plan on keeping a job you have, or finding a new part-time job while you’re in school? Keep in mind, college is more than just tuition and fees. It’s books, supplies, transportation, entertainment, rent, food, etc. So if you’re going to college, you need to find a way to make sure you have financial support throughout the entire four (or more) years.

- Financial Aid. Financial aid can help you cover your college costs. Most schools will require you to complete the Free Application for Federal Student Aid (FAFSA®). The FAFSA is used to award federal financial aid, but states and institutions may also use it to award state and institutional aid. Other schools will require their own financial aid applications and will provide that information on their website.

It is incredibly important that you understand the deadlines for each financial aid application!

- Student Loans. Student loans can help cover the costs of college, but you generally don’t want to rely on these entirely. Borrowing money for college will require you to repay that money plus any accrued interest (the cost of borrowing a loan). But if you have to borrow, it is critical that you consider how much you can afford to repay. Some student loan options will be made available through the federal financial aid program. Federal student loans may be all you need to cover outstanding college expenses, however, if you still have a gap in your financial aid you may need to explore private student loans which are available through various lenders.

- Scholarships. Scholarships can be great resources to pay for college. They can be awarded by colleges, civic organizations, foundations, corporations, or even philanthropic families who wish to support students that demonstrate certain interests, community involvement, demographics, etc. There are thousands of scholarships out there, but they require a little leg-work on your part.

Using a free online search tool will match you to scholarships that are relevant to your background in a variety of ways, such as field of study, sports, academic achievement, community involvement, extracurricular activities or personal attributes. It doesn’t matter what type of program or college you attend, chances are there is a scholarship you are eligible for.

Edvisors also offers a unique scholarship opportunity through www.ScholarshipPoints.comSM, a sweepstakes based scholarship platform. All you need to do is create an account and complete activities to earn points. You can then use those points to enter scholarship drawings, including monthly $1,000 drawings and a $2,500 scholarship. To date, ScholarshipPoints has awarded more than $1 million dollars in scholarships.

Make a list of potential colleges.

Now that you have an idea of the type of college you want to attend, it’s time to compile a list of all of the schools you’re interested in and start doing some research. Using a college review tool, like our School Snapshot Tool, can help you get started.

Compare Colleges: The School Snapshot Tool

The School Snapshot Tool will give you a high-level overview of the schools you are considering, and is a great place to start when whittling down your list of scholarships. Here’s how it works.

1. Enter a school you are considering.

2. Review the Snapshot.

The snapshot tool will provide you with a lot of information about each school you enter.

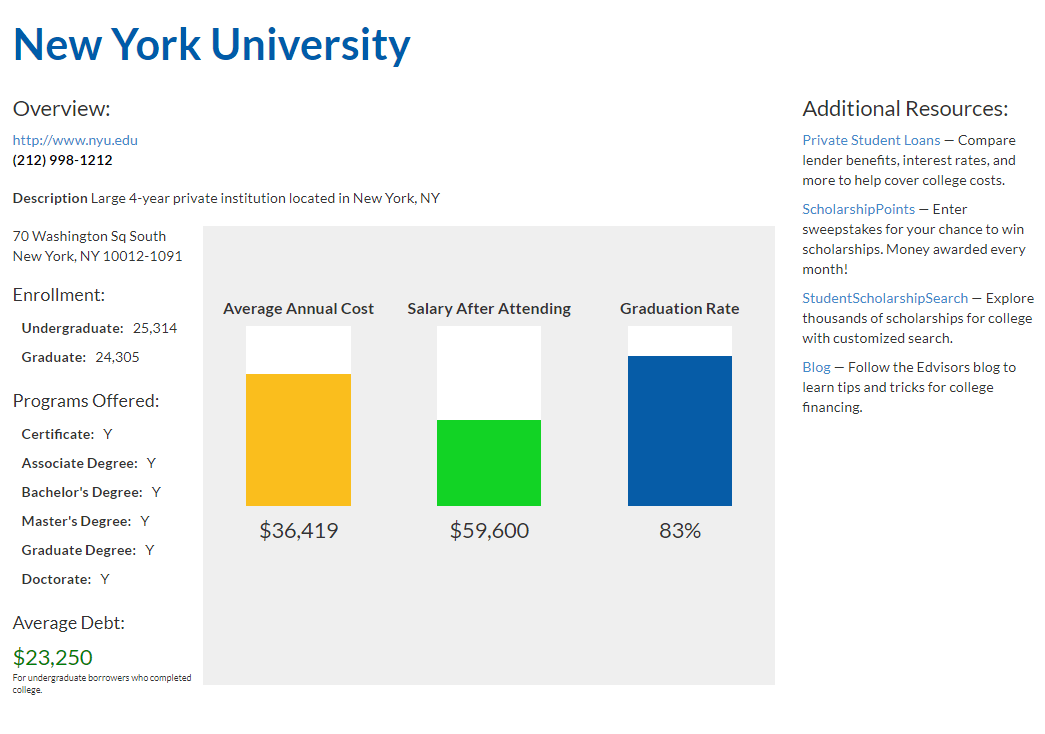

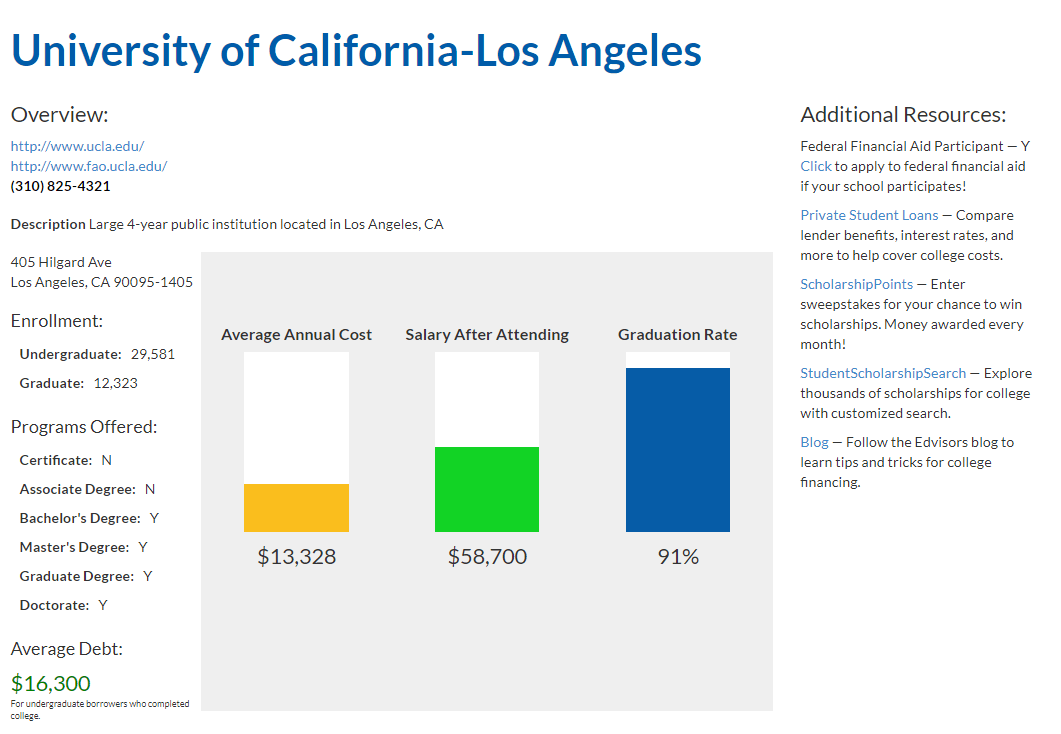

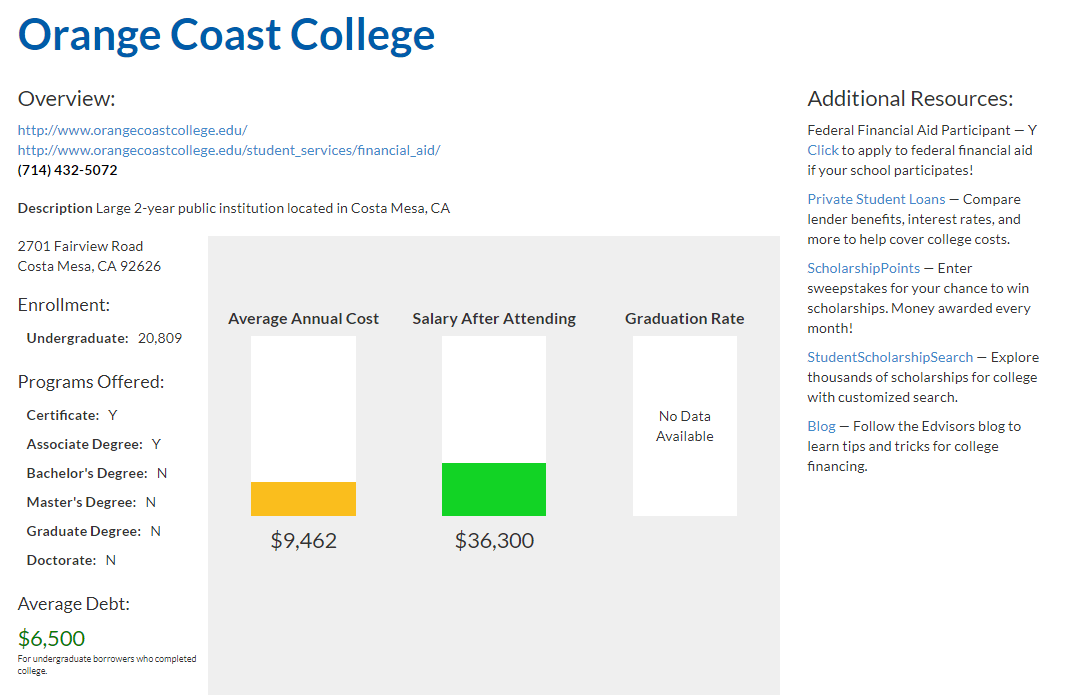

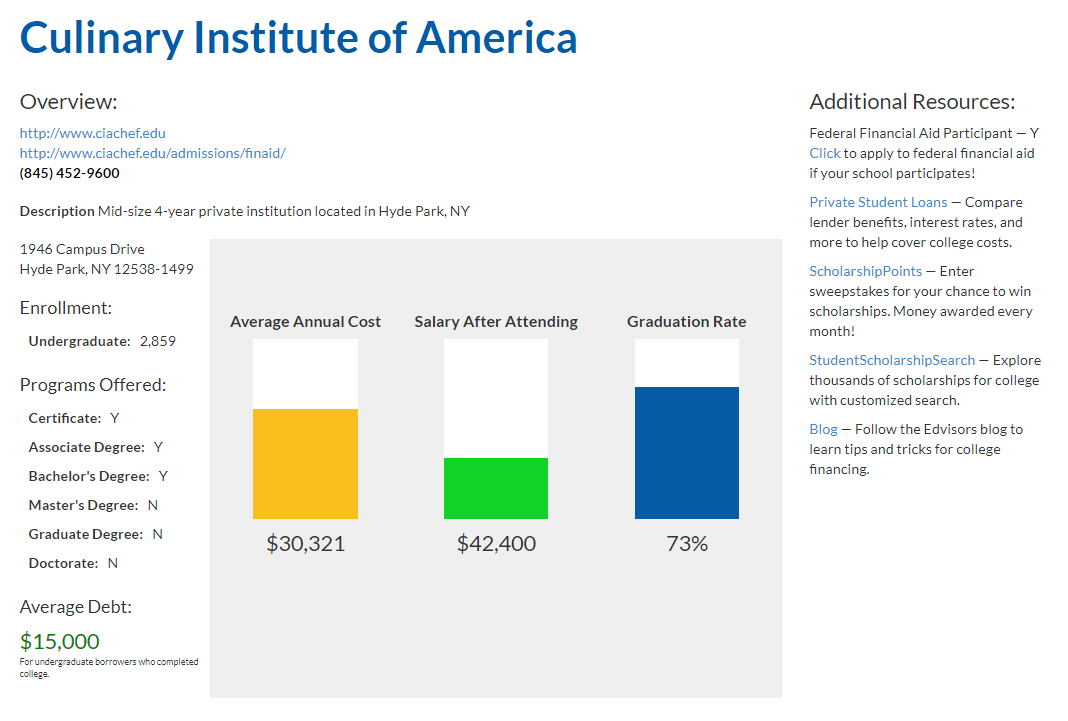

- Average annual cost: This is the average net price for a student after receiving financial aid from the federal government, the school, and the state. This information is only available for schools that participate in federal financial aid. This should not be confused with the school’s determined Cost of Attendance.

- Salary after attending: This identifies the median earnings of former students who received federal financial aid, 10 years after entering the school.

- Graduation rate: The percentage of full-time students who have enrolled for the first time, who completed their program within 150 percent of the expected time of completion. For example, the percentage of full-time students who enrolled for the first time in a four-year bachelor’s degree program and are able to complete that program within six years.

- School location: The city and state in which the school is located. If the school has multiple campuses, this may be where the main campus is situated.

- Important websites: The school’s main site and the financial aid page.

- School size and enrollment: Undergraduate enrollment is used to determine the school size. A small school will have fewer than 2,000 enrolled undergraduate students, mid-size will be from 2,000-15,000, and large will be more than 15,000 enrolled undergraduate students.

- Program types offered: The types of programs the school offers: certificate, associate degree, bachelor’s degree, master’s, or doctorate.

- If they participate in federal financial aid: This will identify if the school participates in federal student aid. This information will be helpful if you are planning on using federal financial aid to help pay for college.

Some examples:

- New York University (NYU). Private four-your institution located in New York.

- University of California, Los Angeles (UCLA). A public four-year institution located in California.

- Orange Coast College. A public two-year institution located in California.

- Culinary Institute of America. A private four-year institution located in New York.

3. Your College List. Apply to the schools that make the cut!

It’s not the worst idea to apply to a school, even if it is out of your budget. There may be additional financial aid available to help you cover the costs. And you should always talk to the financial aid office to make sure you’ve fully explored all the options there may be; especially if the gap between your expected contribution and financial aid is not outlandish.

But do keep in mind that when you apply for college admission you should consider all four (or more) years of expenses, not just your first year of costs. No matter your dream school, you should always include schools on your list that are well within your budget.

It probably took quite a bit of work to get to this point, but you will be happy you powered through. College applications can be time-consuming and costly.

Having a game plan can save you time and money. Good luck!