Summary: Each student loan has borrowing limits. Annual limits determine the amount you can borrow for a single academic year, while aggregate limits set a maximum on your total borrowing throughout the loan program. Furthermore, the loan amount can’t go over your school’s official cost of attendance once other financial aid is deducted.

- Federal student loan limits are determined by the type of loan, the student’s dependency status, and the student’s grade level, and past borrowing history.

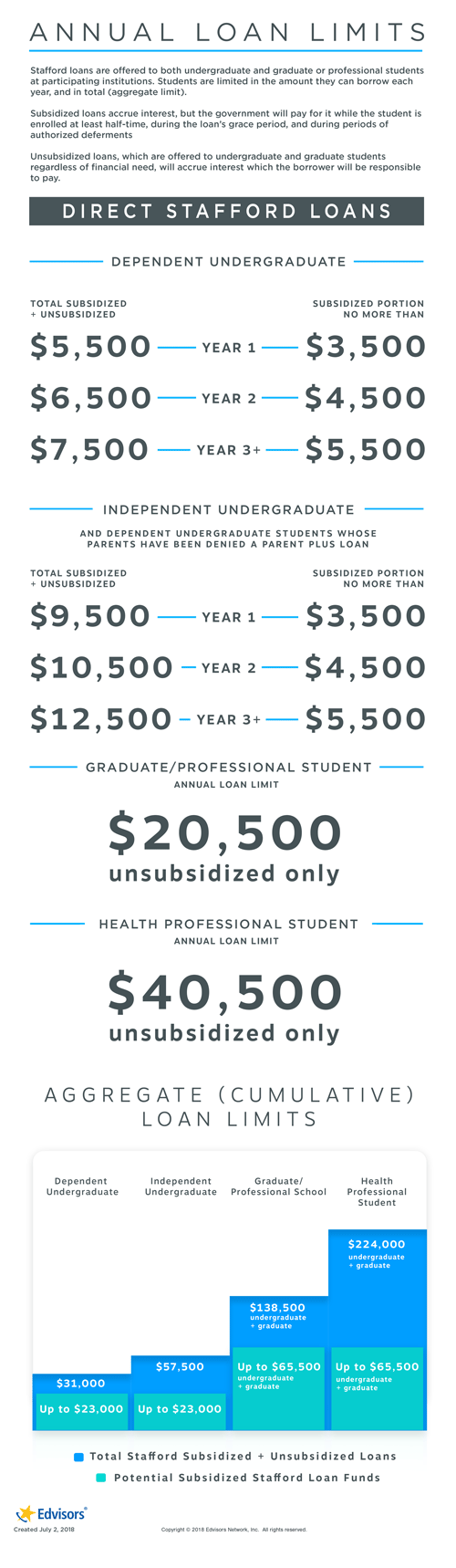

- Dependent undergraduates may borrow up to $31,000 in federal student loans.

- Independent undergraduates may borrow up to $57,500 in federal student loans.

- Graduate or professional students may borrow up to $138,500 in federal student loans, and certain health profession students may borrow up to $224,000.

Is There a Limit On Student Loans?

Yes. Most student loans have several types of limits on the amount you can borrow.

Annual Student Loan Limits

An annual limit specifies the maximum amount you can borrow in a single academic year in each loan program for which you are eligible.

Aggregate Student Loan Limits

An aggregate limit, sometimes called a cumulative limit, specifies the total amount you are allowed to borrow through each loan program. One of the most common loan programs, the federal Direct Stafford Loan program.

Cost of Attendance Loan Limits

Your school's financial aid office cannot provide financial aid that exceeds your cost of attendance, which includes tuition, fees, housing, meals, transportation, and more. Financial aid is usually awarded in the order of scholarships, grants, work-study aid, and then student loans as needed. The cost of attendance (COA) dictates the maximum total cost after deducting other forms of financial assistance you may receive. This COA limit complements or replaces the annual loan limit to ensure that all aid, including student loans, stays within your school's determined budget for attendance.

Remember, making informed decisions about how to finance your education can significantly impact your financial well-being long after graduation.

How Student Loan Limits are Calculated

When you take out a student loan, both the annual and aggregate loan limits are applied to the loan amount. Each type of loan limit represents a restriction on the amount you can borrow.

Sometimes, you may want to borrow an amount that satisfies the annual limit, but you will qualify for a lower amount because your total debt would exceed the aggregate loan limit. You will then be restricted to the lower loan amount.

For example:

The Direct Unsubsidized Loan has annual limits for dependent undergraduate students based on the student’s year in school. The 2025 - 2026 loan limits are:

- $5,500 for freshmen

- $6,500 for sophomores

- $7,500 per year for juniors, seniors, and any additional undergraduate years of study

The Direct Unsubsidized Loan also has an aggregate loan limit of $31,000 for dependent undergraduate students.

Suppose a dependent undergraduate student in a 5-year engineering degree program borrows the annual maximum for each of the first four years, for a total of $27,000. During the student’s fifth year the annual limit would be $7,500. However, as the next table shows, the remaining aggregate loan eligibility is only $4,000 after the end of the fourth year. So, the student can’t borrow the $7,500 annual maximum as a fifth-year senior. Instead, this student can borrow no more than $4,000.

| Year | Annual Limit | Amount Borrowed | Aggregate Debt | Remaining Aggregate Loan Eligibility |

|---|---|---|---|---|

| First Year (Freshman) | $5,500 | $5,500 | $5,500 | $25,500 |

| Second Year (Sophomore) | $6,500 | $6,500 | $12,000 | $19,000 |

| Third Year (Junior) | $7,500 | $7,500 | $19,500 | $11,500 |

| Fourth Year (Senior) | $7,500 | $7,500 | $27,000 | $4,000 |

| Fifth Year (Senior) | $7,500 | $4,000 | $31,000 | $0 |

Private Student Loan Limits

Private student loans come with an annual limit based on the cost of attendance minus other financial aid, such as federal student loans. Undergraduates usually have aggregate loan limits from $75,000 to $120,000, while graduate and professional students may qualify for higher limits. Remember, these limits cover all student loan debt - both federal and private loans combined.

Medical and dental residency and relocation loans and law bar study loans typically have annual loan limits that are 50% lower than the annual loan limits for students who are currently enrolled in school.

Even though you are working with a private student loan lender, your school will still certify the total amount you are able to borrow. Your school will let your lender know if adjustments needs to be made in order to ensure you are not offered financial aid (which includes student loans) in excess of your cost of attendance minus other aid received.

Federal Student Loan Limits

A federal student loan limit isn’t the amount you will be able to borrow, it’s the maximum the school can approve you to borrow. Your school might give you less than the loan limit.

The annual and aggregate borrowing limits on federal student loans vary based on several factors:

- Loan Program (Direct Subsidized Loan, Direct Unsubsidized Loan, or Direct PLUS Loan)

- Dependency Status (Dependent or Independent)

- Year in School or Grade Level (Freshman, Sophomore, Junior, Senior, or Graduate Student)

- Health Professional Student

If your grade level changes in the middle of the academic year, you may qualify for higher annual loan limits. You would then be eligible to borrow the difference between the new annual loan limit and the amount you already borrowed during the same academic year.

Similar rules apply to transfer students. Transferring from one school to another does not reset the loan limits. This can get a little tricky is you are transferring in the middle of an academic year. Your school will essentially let you borrow the difference between your annual loan limit at the new school and the amount received at the previous school. All loans borrowed through a loan program (i.e., Direct Stafford Loans) will count towards your aggregate loan limit.

Loan fees (which may be added to the loan balance) and capitalized interest do not count against the loan limits.

Direct Subsidized and Unsubsidized Loan Limits

Your school's financial aid office determines how much you will be able to borrow each year. This amount might be less than the annual loan limit.

When it comes to the Direct Stafford Loan program, it's important to remember there are two types of loans in the this loan program: Direct Subsidized Loans and Direct Unsubsidized loans. Although these loans are part of the same program, Direct Subsidized Loans have their own limits.

Eligibility for Direct Subsidized Loans is based on demonstrated financial need, up to the annual and aggregate loan limits. (As of July 1, 2012, students attending graduate school or professional school are no longer eligible to borrow new Direct Subsidized Loans.)

One more thing to keep in mind, beyond annual and aggregate loan limits, there is a maximum eligibility period for you to receive Direct Subsidized Loans. For first-time borrowers whose first loan was obtained on or after July 1, 2013, there is a maximum eligibility period of time that you can receive Direct Subsidized loan funds. You are only able to receive Direct Subsidized loans for no more than 150% of the published length of your program.

For example, if you are enrolled in a four-year degree program, the maximum amount of time you can receive Direct Subsidized loan funds is 150% of four years, which is six years.

Eligibility for Direct Unsubsidized Loans does not depend on demonstrated financial need.

Aggregate loan limits, sometimes referred to as cumulative limits, may be refreshed by repaying the debt. So, if you have hit the aggregate loan limit, you will need to pay down your loan before you will be eligible to borrow more.

The aggregate loan limits for students attending graduate school or professional school students include any undergraduate federal student loan debt.

Borrowing Limits for Direct Subsidized and Unsubsidized Loans

Direct Unsubsidized Loan Limits for Health Profession Students

Health profession students, such as students enrolled in medical school, are eligible for higher Direct Loan limits.

There are two different levels of increased loan limits, depending on the area of study (see table). These limits are available only to health profession students enrolled at U.S. colleges and universities. Students enrolled at foreign institutions are not eligible.

| Health Professions Programs Eligible for Higher Direct Unsubsidized Loan Limits |

Direct Unsubsidized Loan Limit

9-Month Academic Year

|

Direct Unsubsidized Loan Limit

12-Month Academic Year

|

|---|---|---|

|

$40,500 | $47,167 |

|

$33,000 | $37,167 |

Some schools may also offer 10-month or 11-month academic programs, which would have different annual limits than those listed here. Check with your school’s financial aid office to get the limits for your program.

Other Direct Loan Limits

Additional Loan Funds for Preparatory Coursework

- All students: Up to $2,625 for coursework required for enrollment in an undergraduate degree or certificate program

- Bachelor’s degree recipients: Up to $5,500 for coursework required for enrollment in a graduate or professional degree or certificate program

- Bachelor’s degree recipients: Up to $5,500 for state-required teacher certification coursework

These loan funds are limited to a period of 12 consecutive months. Any loans received for preparatory coursework will be counted towards your Direct Loan aggregate loan limits.

If Parents Refuse to File the FAFSA

If the parents of a dependent undergraduate student decline to complete the FAFSA (Free Application for Federal Student Aid), the college's financial aid administrator may still permit the student to borrow additional Direct Unsubsidized Loans, even if the FAFSA is incomplete. Keep in mind that the student will not be eligible for the Direct Subsidized Loan, the Federal Pell Grant, or other types of federal student aid.

Increased Direct Unsubsidized Loan Limits for Dependent Undergraduate Students

There are times when a dependent student can become eligible for the same Direct Unsubsidized Loan limits as independent students:

- Parents are denied eligibility for a Parent PLUS Loan

- Other documented "exceptional circumstances," even if parents aren't denied eligibility for a Parent PLUS Loan

In some exceptional circumstances, college financial aid administrators may allow a dependent undergraduate student to borrow at the higher Direct Unsubsidized Loan limits available to independent students without requiring the parent to obtain a denial of a Parent PLUS Loan. For example, you would need to successfully qualify for a dependency override.

College financial aid administrators aren't required to make the student eligible for the higher loan limits, even if exceptional circumstances exist.

Prorated Annual Loan Limits for Undergraduate Students

Annual loan limits for Direct Loans are prorated (adjusted) for undergraduate students who are enrolled in programs that are:

- Shorter than one academic year; or

- Remaining period of study is shorter than one academic year

For example, if an undergraduate student in a 4-year Bachelor’s degree program will be graduating at the end of the fall semester (halfway through the academic year), the student is eligible for half of the annual loan limit for seniors.

Half-time students are eligible for the same annual loan limits as full-time students.

Direct PLUS Loan Limits

The annual loan limit for the Direct PLUS Loan (Parent PLUS Loan or Grad PLUS Loan) is the annual cost of attendance minus other aid received during the enrollment period. There is no aggregate loan limit. The loan limits are the same for both parents of undergraduate students as well as graduate students.

Direct Consolidation Loan Limits

There are no limits on Direct Consolidation Loans (also known as Federal Consolidation Loans), other than the underlying limits on the loans included in the consolidation loan.

Recommendations

- File the FAFSA every year to maintain your eligibility for student aid.

- When you compare different types of student loans, make sure you understand both the annual and aggregate loan limits.

- If you are a dependent undergraduate student and your parents won’t qualify for a Parent PLUS Loan due to an adverse credit history, encourage them to apply anyway because a denial will make you eligible for the same Direct Loan limits as an independent student.

- If you’ve hit the annual and/or aggregate limits on federal loans, but you still need additional funds to complete your education, consider private student loans as a potential option.

What to Read Next

Best Private Student Loans for July 2025

Financial Aid for Graduate School